KiwiSaver government contribution

Time is ticking - grab your share of the KiwiSaver government contribution for 2024.

For every $1 you contribute the government will contribute 50 cents, up to a maximum government contribution of $521.43.If you’re an AMP customer:

If you’ve chosen AMP as your preferred KiwiSaver scheme provider, you can get your most up-to-date information at MyAMP. To check your contribution balance log into MyAMP online (this function is not currently available in MyAMP app).

The KiwiSaver initiative is designed to help you prepare for the biggest financial challenges in your life. It can turn dreams into reality, like buying your first home and planning a comfortable retirement.

But is your AMP KiwiSaver Scheme account growing as fast as it could be? One element to consider is whether you are securing the maximum government contribution possible? Every year you could enjoy a lump sum payment of $521.43 in the form of a KiwiSaver government contribution, but many New Zealanders aren’t currently taking advantage of this benefit of the KiwiSaver initiative.

In isolation this annual government contribution may not seem like a lot. But if you continue to secure the full amount year after year, these contributions can add up over time.

What is the KiwiSaver government contribution?

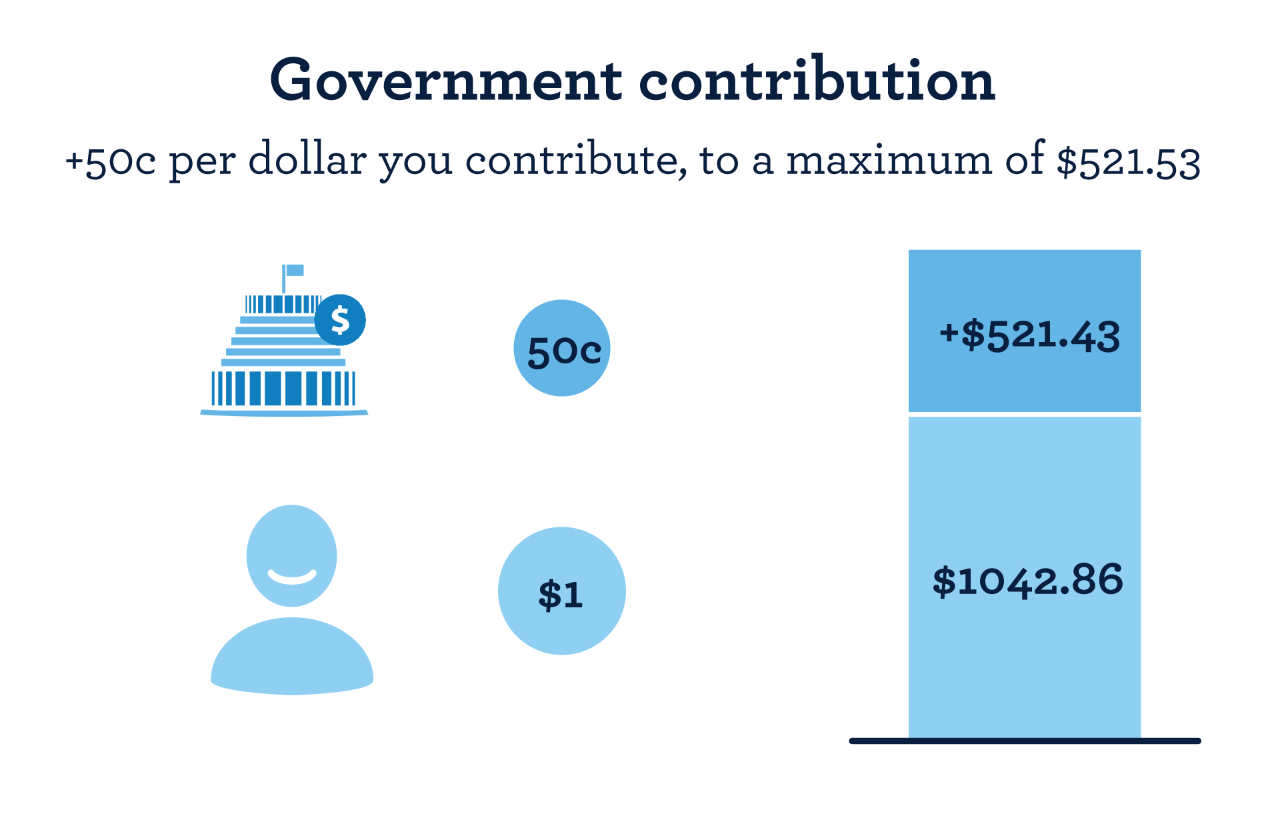

The KiwiSaver government contribution is an annual contribution to reward you for growing your KiwiSaver. For every dollar you put into your KiwiSaver account, the Government puts in 50 cents, up to the maximum government contribution of $521.43 per year.

To receive the full $521.43, you need to have been a member for the full KiwiSaver year (starting 1 July) and have personally contributed at least $1,042.86 into your KiwiSaver account between 1 July of the previous year and 30 June of the current year. (You have until 21 June to top up your AMP KiwiSaver Scheme account to allow for processing).

If you aren’t a member for the full year, you'll only get a portion of the government contribution equal to your part year membership. If you can't contribute the full $1,042.86 you will still receive 50c for every dollar you do contribute.

This Government contribution is paid to your KiwiSaver provider and for AMP members, will show in your AMP KiwiSaver Scheme account in late July or early August.

Watch our video explaining how the KiwiSaver government contribution works

Are you maximising on the KiwiSaver government contribution?

Most New Zealanders want to maximise their KiwiSaver savings. This effort may help you prepare for retirement or secure your first home, depending on where you are in life. The KiwiSaver Government contribution scheme is designed to encourage voluntary KiwiSaver contributions. The incentive is money – in essence the Government is paying you to top up your own contributions.

If you are not making the most of this benefit, you could be missing out on thousands of dollars in Government contributions over your working life.

On the flipside, if you are making the most of this benefit, you can rest easy knowing you are doing all that you can to maximise on the KiwiSaver Government contribution.

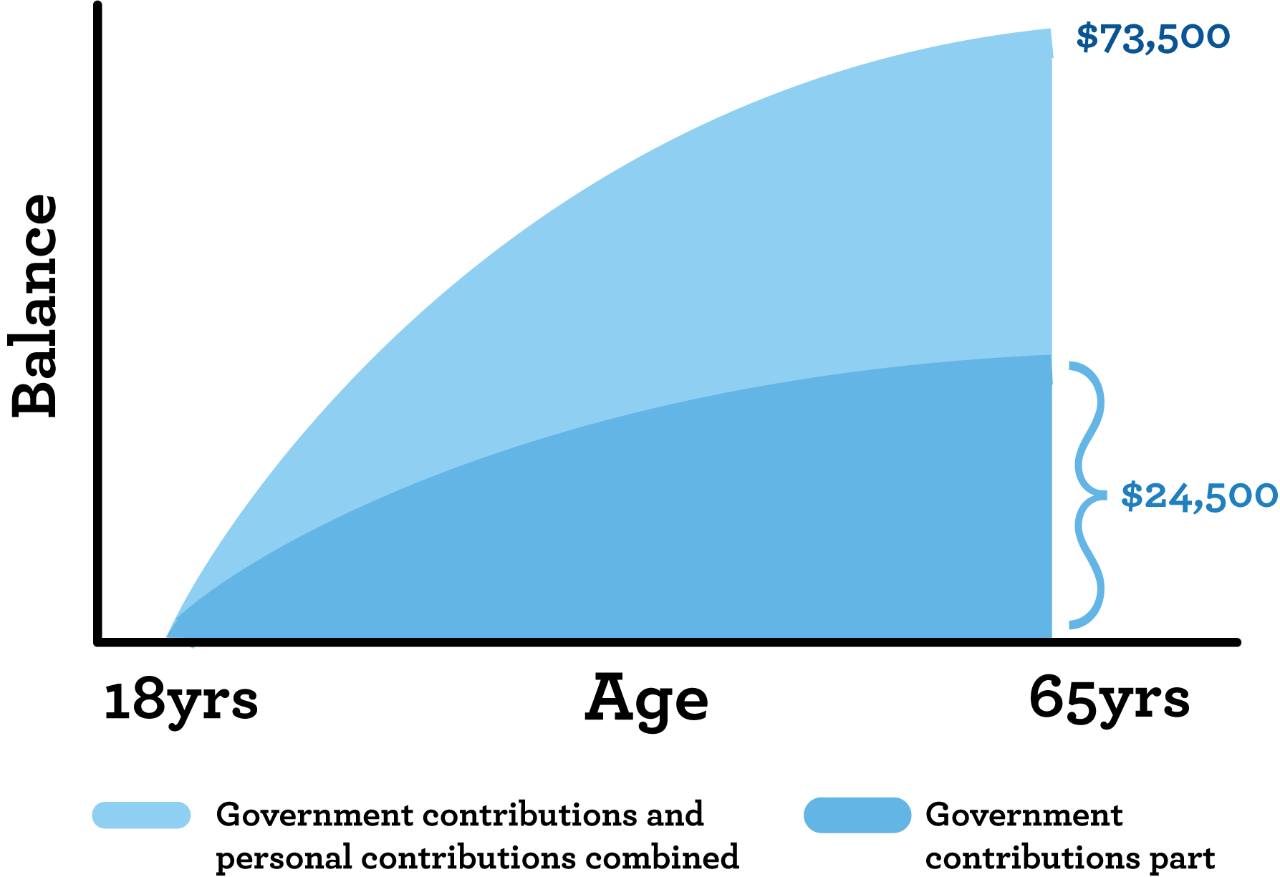

Contributing regularly makes a big difference

This graph indicates the cumulative effect of your regular contributions and the Government contribution if you joined at age 18 and remained an eligible member of KiwiSaver until 65. Over a lifetime the Government contribution can amount to more than $24,500 for your retirement.

Am I eligible for the KiwiSaver government contribution?

A set of eligibility criteria apply to the KiwiSaver Government Contribution. In general terms, you will be eligible if you:

- Are a contributing KiwiSaver member.

- Are aged 18 or over.

- Mainly live in New Zealand.

- Are a government employee serving outside New Zealand.

- Are working overseas as a volunteer, for token payment, or for a charitable organisation named in the Student Loan Act regulations, and the work meets one or more of the requirements set out in the Student Loan Scheme Act 2011.

- Are not eligible for a retirement withdrawal.

You can also check the Inland Revenue Department website, for more on the government contribution and exclusions.

How can I check my KiwiSaver contributions?

To maximise the Kiwisaver Government contribution you should aim to contribute $1,042.86 to your AMP KiwiSaver Scheme account for the year starting 1 July. There are two ways to check your contributions for the current financial year.

If you’re unsure who your KiwiSaver account is with

If you don’t know where your KiwiSaver account is held or who is your KiwiSaver scheme provider, the best way to check, and see the total contributions you've made so far this KiwiSaver year, is by logging into your myIR account.

Visit ird.govt.nz/kiwisaver and click ‘My Kiwisaver’ in the top right hand cover. Here you can view all the money deducted from your salary (if any) for your KiwiSaver account and paid via Inland Revenue.

Haven’t used myIR before? It's easy to login or register for the first time – all you'll need is your IRD number.

It's important to use ird.govt.nz/kiwisaver if you are an employee, as the Government calculates your Government contribution entitlement based on when IRD receives your contributions, not when they're paid into your AMP KiwiSaver Scheme account.

If you’re an AMP customer

If you’ve chosen AMP as your preferred KiwiSaver scheme provider, you can get your most up-to-date information at MyAMP. When you first joined the AMP KiwiSaver Scheme, you were given a username and password; if you have logged on previously, these are still valid.

If you have not previously checked your balance online, or have forgotten your details, you can retrieve your username and password or register for the first time online. You'll just need your AMP KiwiSaver Scheme member number.

How do I make a voluntary or extra KiwiSaver contribution?

Perhaps you have checked your voluntary contributions and found that you haven’t yet reached the $1,042.86 threshold. Perhaps you’re self-employed and need to make your own contributions. Perhaps you simply want to put some money away for retirement, because you know it will help you later.

Here's how you can make a voluntary contribution to your KiwiSaver.

Quick and easy with MyAMP

There are three ways you can make voluntary contributions through MyAMP online or via MyAMP mobile app:

1. Make a one-off contribution (up to $100,000).

2. You can set up regular direct debit contributions (no limit).

3. You change the KiwiSaver contribution percentage (3%, 4%, 6%, 8% or 10%, default is 3%) of your pay that forms your voluntary contribution.

New to MyAMP? Register now

Contribute now

Online banking

You will need your KiwiSaver number or policy number, and access to your bank’s internet banking portal.

1. Log in to your bank's website

2. Select AMP from the list of payees

3. Enter the details below

4. Follow your bank’s instructions to complete the contribution

AMP KiwiSaver Scheme:

Account: AMP-KIWISAVER SCHEME

Particulars: Your surname (Eg: Bloggs)

Code: Your IRD number

Reference: Your KiwiSaver member number

What happens if I contribute more than $1042.86 to my KiwiSaver?

The Government will not make additional contributions on any amount above $1,042.86 that is paid in this KiwiSaver year. However, making extra voluntary contributions when you can afford to can be a good way to grow your retirement savings or for a first home deposit. While a minimum contribution amount applies to employer contributions and employee contributions, there’s no such thing as a maximum contribution.

Looking for expert KiwiSaver advice?

Speak with our experts on the AMP KiwiSaver Scheme today.

Maximise your KiwiSaver with AMP

Most Kiwis should look to boost the value of their KiwiSaver account, and government contributions are just one element. Follow the links below to find out how to grow your savings for your retirement or for a first home deposit.

AMP KiwiSaver Scheme: how it works

Our explainer tells you all you need to know about the KiwiSaver scheme.

How KiwiSaver works

Saving for your first home

As a first home buyer you can access your KiwiSaver account to boost your deposit. Here’s how.

Read more

Will I have enough money in retirement?

How much money do you need to retire comfortably? It’s a tricky question, but one that our retirement calculator is built to answer.