A Little Help with the advice we provide at AMP NZ

AMP Services (NZ) Limited (FSP38082, “AMP NZ”) holds a licence issued by the Financial Markets Authority to provide a financial advice service.

The types of products on which AMP NZ provides financial advice

AMP NZ (together with its advisers and nominated representatives) gives customers financial advice on investment and retirement savings products such as KiwiSaver, and general insurance products such as home and contents insurance.

AMP NZ provides financial advice only on AMP branded products that are issued by:

• AMP Wealth Management New Zealand Limited (a related company of AMP NZ) for investment and retirement savings products; and

• Vero Insurance New Zealand Limited for general insurance.

Limitations on AMP NZ’s financial advice

AMP NZ focuses on providing "a little help" to its customers. Accordingly, the financial advice provided is restricted to more simple scenarios (e.g. fund selection) and we will only consider limited customer information as part of our advice process.

Where a customer's needs are identified as being complex, AMP NZ may refer customers to its related company AdviceFirst, which provides a more bespoke financial advice service.

Fees, expenses or other amounts payable for financial advice from AMP NZ

AMP NZ does not charge fees and no expenses or any other amounts are payable, for financial advice provided to customers.

Conflicts of interest, commissions or other incentives relating to AMP NZ’s financial advice

As AMP NZ only provides financial advice on AMP branded products (refer above), AMP NZ does not usually make comparisons with non-AMP branded products, However, in the event that we do make a comparison it will be limited and made on the basis of publicly available information. If more detailed comparisons are wanted, customers should seek advice from another Financial Advice Provider.

AMP NZ receives commission from the insurance companies about whose policies it gives advice. If a you decide to take out insurance, the insurer will pay a commission to AMP NZ. The amount of the commission is based on the amount of the premium.

AMP NZ’s financial advisers and nominated representatives are remunerated by salary and an incentive related annual bonus which will be determined with reference to a range of factors, such as conduct and productivity.

To ensure that AMP NZ’s advisers and nominated representatives prioritise customer interests above their own, advice processes are followed that ensure recommendations are made based on customer needs, general goals and circumstances. All AMP NZ’s advisers and nominated representatives complete annual training on how to manage conflicts of interest. We maintain and monitor registers of conflicts of interest, and the gifts and incentives we receive over a certain limit.

Complaints Handling and Dispute Resolution

If you have a complaint about our financial advice, in the first instance you may phone 0800 267 005, email service@amp.co.nz, or write to:

AMP Services (NZ) Limited

PO Box 55, Shortland Street

Auckland 1140

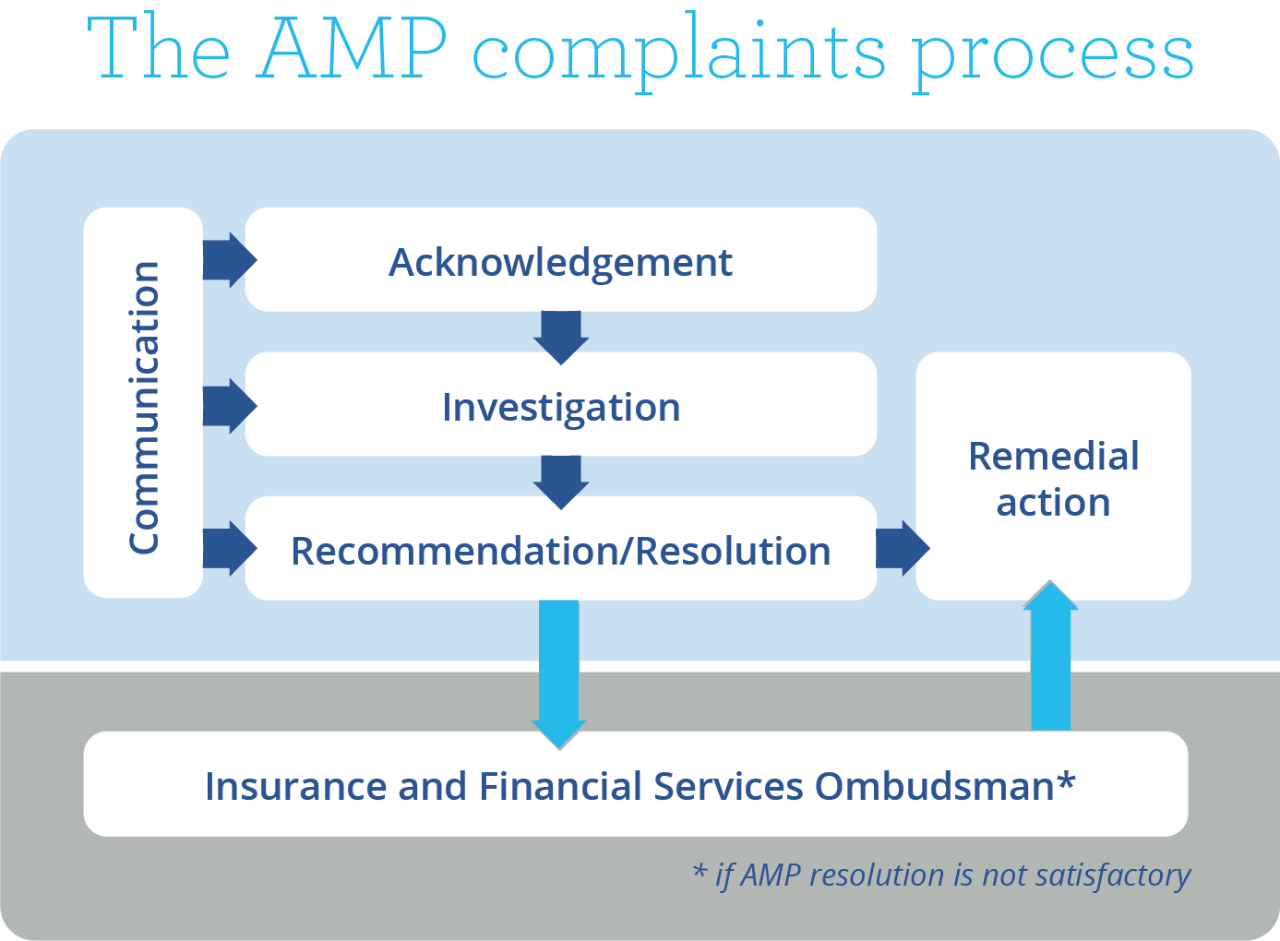

When you raise a complaint, we will:

• Acknowledge your complaint in a timely manner and give you assurance that we'll investigate;

• Investigate your complaint and give you an explanation of what happened and why; and

• If required, work with you to reach a fair resolution.

AMP NZ’s complaints process is graphically illustrated below:

For further information on AMP NZ’s complaints process refer to https://www.amp.co.nz/contact/feedback.

If we can't resolve your complaint or you don't think your complaint has been addressed sufficiently, you can contact the Insurance & Financial Services Ombudsman Scheme. This is a free, independent dispute resolution service available to consumers, which may help investigate and resolve your complaint.

You can contact the Insurance & Financial Services Ombudsman Scheme using the following details:

Post - PO Box 10-845, Wellington, 6143

Phone - 04 499 7612 or freephone 0800 888 202

or Email - info@ifso.nz.

AMP NZ, and anyone who gives advice on its behalf, have duties in the Financial Markets Conduct Act 2013 relating to the way that we give advice.

Duties Information

AMP NZ, and anyone who gives financial advice on our behalf, have duties under the Financial Markets Conduct Act 2013 relating to the way that we give advice.

We are required to:

• Give priority to clients’ interests;

• Exercise care, diligence and skill;

• Meet standards of competence, knowledge, and skill set by the Code of Professional Conduct for Financial Advice Services; and

• Meet the standards of ethical behaviour, conduct, and client care set by the Code of Conduct for Financial Advice Services.

This is only a summary of the key duties we have. More information on our duties can be found on the Financial Markets Authority website.