Your quarterly market commentary

April 2024

Overview:

- Strong start to 2024: The first three months of 2024 brought excellent returns for investors in AMP-branded funds, building on a strong 2023. Share markets surged globally due to decreasing price pressures, strong US corporate earnings, and expected interest rate cuts, leading to positive returns for customers.

- Global market performance: The US market rose by 10.3%, its best first-quarter performance in five years. Europe saw over 7% growth, while Australia gained 5%. Japan stood out with nearly 20% growth, aided by corporate reforms and a weakened yen.

- Investment strategy review: AMP reviews its strategic asset allocation annually to ensure portfolios are positioned well for future market conditions. This involves analysing risk and return expectations over the next five years.

- Interest rate cuts expected: Central banks, including the Federal Reserve, are expected to begin lowering interest rates, with three cuts anticipated for 2024. This expectation is based on declining inflation globally and resilient economic growth.

- New Zealand economic challenges: New Zealand's economy faces ongoing price pressures, with inflation yet to reach target levels. Economic growth has contracted, leading to concerns. Interest rate cuts in New Zealand may lag behind global peers, with the Reserve Bank expected to act cautiously based on economic data.

Summary

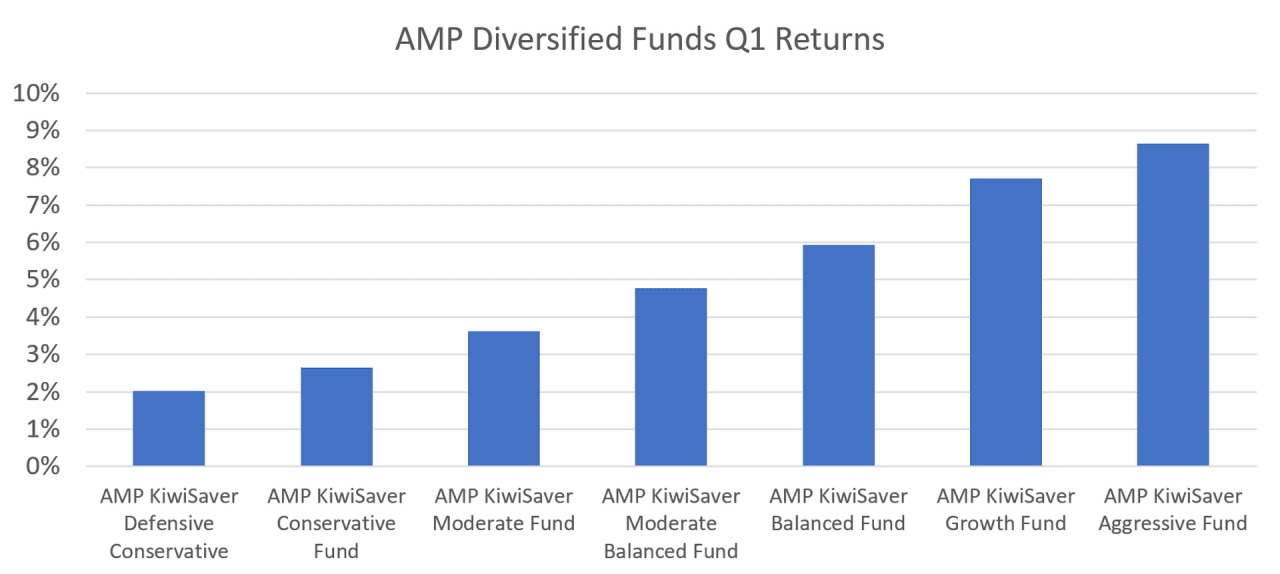

The first three months of 2024 delivered excellent returns for customers invested in our AMP-branded funds, continuing the momentum from a strong 2023. Global price pressures continuing to subside, a strong US corporate earnings season, and the prospect of interest rate cuts have pushed share markets higher, delivering positive returns for customers. To illustrate the strong start to 2024, this chart shows the returns of the AMP diversified funds over the past three months.

Returns after total fund charges and before taxes

Strong investment returns in Q1

The start of 2024 kicked off on a positive note with strong returns across the board, particularly out of the US, with the broader share market finishing the quarter up 10.3% - its best first-quarter performance in five years. The enthusiasm in the market came amid a strong corporate earnings season, expectations of future interest rate cuts, inflation continuing its downward trend, and economic growth remaining surprisingly resilient. The latest economic data is supportive of the rhetoric that the US economy can achieve the Federal Reserve’s desired ‘soft-landing’ outcome, or even better, no ‘landing’ at all. This is a good outcome for investment markets, and subsequently, customer returns.

Strong investment returns over the quarter weren’t just limited to the U.S. The European share market finished the quarter up over 7%, while Australia performed well with a 5% gain. New Zealand continued to lag behind its larger developed global peers with a gain of around 3%, while China’s share market managed to eke out a small gain following the announcement of further Government measures to stimulate the economy. Japan’s share market delivered exceptional returns, up close to 20% for the quarter, as recent corporate governance reforms have resulted in an increase in company shareholder returns, alongside the Yen hovering at its lowest level in nearly 30 years, which makes foreign investment into Japan more appealing, combined with boosting Japan’s export income.

Relative to our peers in the KiwiSaver market, overweight exposure to Global Equities benefitted the returns of our diversified portfolios over the quarter, as did the inclusion of NZ Corporate Bonds and Inflation Linked Bonds. Our greater foreign currency exposure also provided additional support, given the drop in the New Zealand Dollar.

We are currently in the process of reviewing our strategic asset allocation, a task we undertake on an annual basis in conjunction with our investment partner, BlackRock. This review involves analysing the risk and return expectations of various asset classes over a 5-year period to ensure the AMP diversified portfolios are positioned appropriately for our expectations for the future market environment.

Interest rate cuts on the horizon

A strong catalyst for recent market gains has been the expectation that Central Banks will soon begin lowering interest rates. The Federal Reserve is widely expected to begin cutting interest rates in late Q2 or early Q3, with a total of three cuts pencilled in for 2024. Recent commentary by the European Central Bank and the Bank of England have also boosted market sentiment, supporting the narrative that borrowing costs will decrease in 2024.

The expectation of interest rate cuts on the horizon, along with recent comments from Central Banks, are a sign that inflation data globally is continuing its downward trajectory. Inflation targets differ between countries, however, what is common is the fact that inflation has been moving in the right direction. Annual inflation in the U.S was sitting at just 3.1% in February, while in the UK it was 3.4% - far lower than the levels experienced in 2023. Market sentiment has also been supported by resilient economic growth numbers and a strong labour market.

Generally, the markets expectations of interest rate moves are now broadly in-line with Central Bank forecasts. Heightened market movement can often occur when the markets expectations aren’t met, therefore having similar expectations is helpful. The expectations of interest cuts have been priced into the market, which has supported the investment returns experienced during the first quarter of 2024.

Over the past two years, Central Banks around the world have tightened monetary policy, by increasing interest rates, to levels not experienced in decades. Central Banks have also made it clear that interest rate decisions going forward will be made utilising the latest available data, which will need to clearly show inflation is under control. A current concern is the risk of inflation re-surging when rates are lowered, therefore we don’t expect central banks to cut rates before they are confident inflation is going to remain on its downward trajectory.

New Zealand economy

The timeline for interest rate cuts in New Zealand is possibly going to lag global peers, as the economy continues to face ongoing price pressures. The latest inflation data shows that while inflation is on its way down, non-tradeable inflation, otherwise known as domestic inflation, remains elevated. The Reserve Bank of New Zealand will want to see inflation make more significant movement towards the 1-3% target range before beginning to lower interest rates. Based on the latest forecasts, the RBNZ sees inflation returning to the target range in the September quarter this year.

Along with elevated levels of inflation, economic growth in New Zealand is a challenge. The economy contracted in the last quarter of 2023, meaning that New Zealand is in a technical recession – defined as two consecutive quarters of negative growth. This comes despite the country experiencing near-record levels of net migration, with a net gain of 126,000 people last year. Based on the Reserve Bank’s forecasts, an interest rate cut isn’t expected until 2025, but this has the potential to change as further economic data becomes available.

Market Outlook

Looking forward to the rest of 2024, the beginning of the cycle of interest rate cuts in major developed economies could be positive for investment markets. It is expected, however, that central banks will take a more cautious approach to lowering interest rates, utilising the most up-to-date data available. To avoid inflation re-surging, only when central banks have confidence that inflation is on the right trajectory will they decide to cut rates.

Global economies will experience different interest rate paths from one another. This is why we believe it is important to have a well-diversified portfolio and to focus on your long-term objectives. These considerations are all a part of our strategic asset allocation review process that we are currently undertaking; to position our diversified portfolios for the potential market environment based on our future forecasts.

Thanks for reading our first market commentary for 2024. We look forward to continuing to bring these to you regularly throughout the year, and as always, if you need a little help with your savings goals or have any questions about your savings or investments, please contact your adviser or AMP for a little help.