Market commentaries: archive

Market commentaries from previous months are shown below.

Previous investment market commentaries

Overview

- Strong market performance: Global share markets rose sharply in the third quarter of 2025, with technology and AI companies leading the way. Many AMP KiwiSaver Scheme funds grew more than 5% over the quarter.

- Interest rates easing: Central banks, including New Zealand’s, began cutting interest rates as inflation came down. This helped both share and bond markets deliver positive returns.

- Trade outlook improving: Recent progress in trade talks between major countries reduced uncertainty and helped lift investor confidence.

- Outlook remains positive: Lower interest rates and steady company earnings are supporting markets, but staying diversified and focused on long-term goals remains important.

Third quarter 2025 market review

The third quarter of 2025 delivered broad gains across almost all major asset classes, as several positive forces came together: easing global trade tensions, continued enthusiasm for technology/AI, and the start of interest rate cuts by central banks. Equity markets around the world surged to new highs and bond prices rose as yields fell. We highlight three key themes from this quarter - a global equity rally led by technology, a pivot in central bank policy that boosted bond prices, and an improving trade backdrop.

This is evidenced in returns over the quarter with many AMP KiwiSaver Scheme funds posting more than 5% growth during the quarter. This continues a strong run of returns for Kiwi savers (and other savers) over the past few years. To view the latest AMP KiwiSaver Scheme returns, please view them here: KiwiSaver returns September 2025

Equity markets reach record highs in broad rally

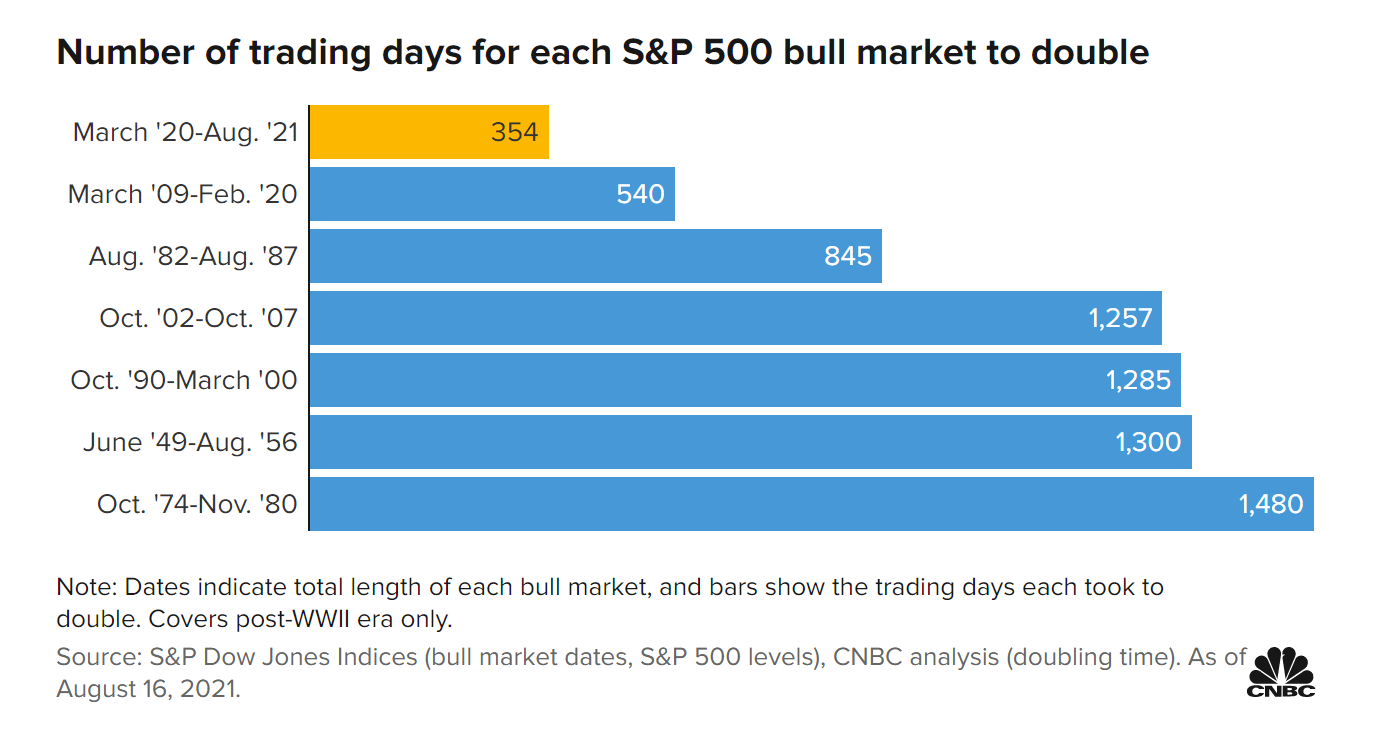

Global equities surged in the third quarter of 2025, marking one of the strongest quarters in recent years. All three major U.S. indices (Dow Jones, S&P 500 and Nasdaq) hit new all-time highs, underscoring the resilience of the market. This rally was driven by robust corporate earnings and continued excitement around technology. During the latest reporting season round, over 80% of firms that reported earnings beat profit expectations making it one of the best earnings seasons on record.

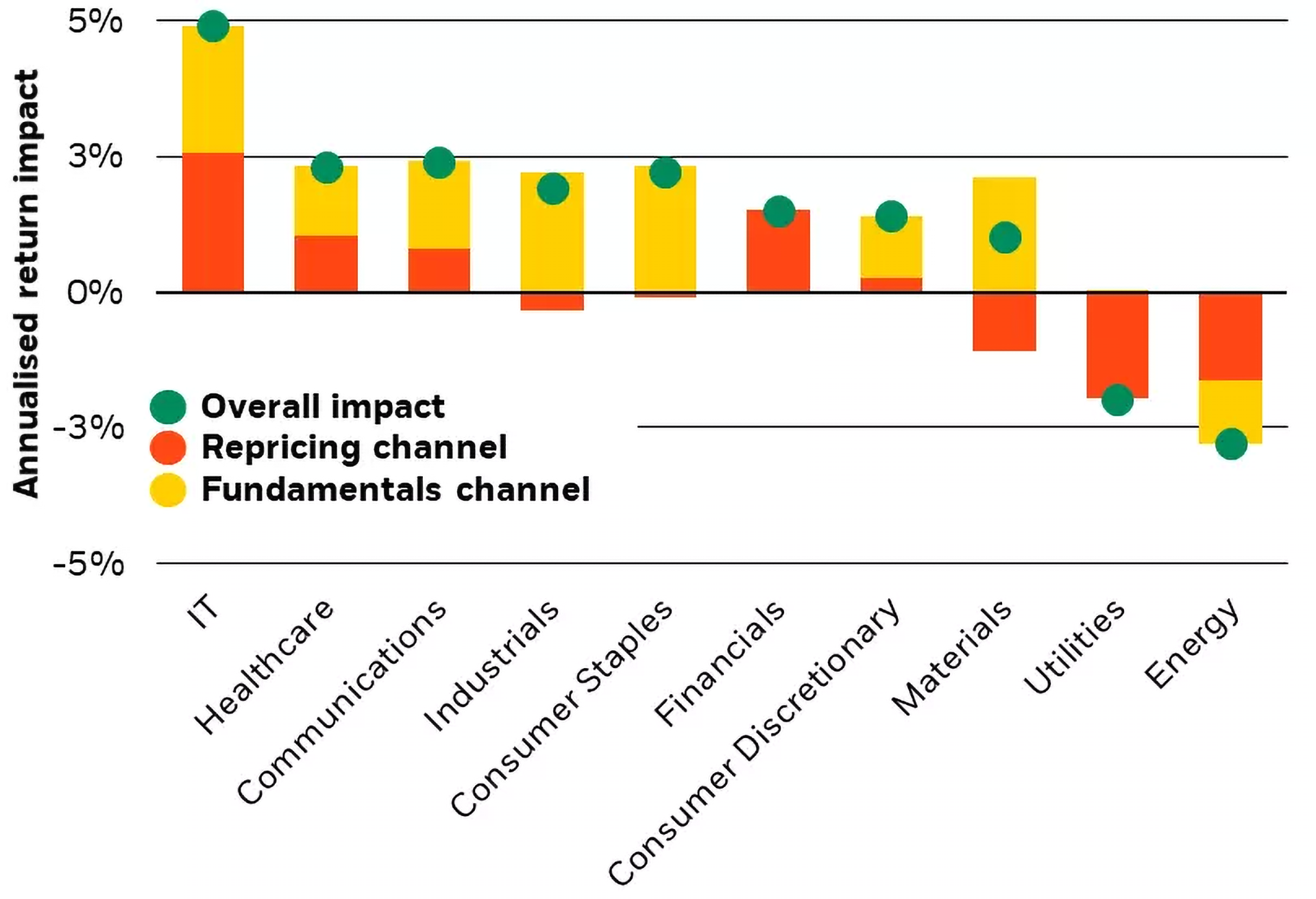

Technology and AI-related shares led the charge and growth-oriented sectors like Technology, Communication Services, and Consumer Discretionary outperformed more value-oriented sectors.

International markets also rose, riding the same wave of optimism. Developed market shares in Europe and Asia advanced in tandem with U.S. shares during the quarter with most major indices up on the order of 5-10%. Europe’s biggest economy, Germany, struggled with industrial stagnation and the market was down slightly.

Interest rates fall, bonds rebound as central banks pivot

A major development in the third quarter of 2025 was the pivot in monetary policy. After an aggressive rate-hiking cycle from 2022 to 2024 to combat inflation, central banks have now begun cutting interest rates as inflation pressures ease. In late September, the U.S. Federal Reserve cut its benchmark rate by 0.25% - the first reduction of 2025. This brought the federal funds rate down to roughly 4.0-4.25%, and it was a widely anticipated move. Fed officials justified the cut by noting signs of a slowdown in the labour market and economy (job growth has cooled and revisions showed the U.S. economy wasn’t as robust as earlier thought) even as inflation remains just under 3%. The Fed also hinted that further easing is on the horizon, which boosted market confidence that interest rates have peaked for now.

Bond markets welcomed the turn in policy. As interest rate expectations shifted downward, bond yields fell, and prices correspondingly rose. Globally, the picture was mixed but generally supportive for bonds. In Europe, political worries - such as a large budget deficit in France and uncertainty around fiscal policy pushed some European yields up, offsetting the general rate decline.

New Zealand’s central bank cut its official rate by 0.25% earlier in 2025 and indicated more cuts could follow to support growth and it reflects a broader trend: from Asia to Latin America, the interest rate cycle has largely turned downwards as inflation comes under control. Lower rates tend to reduce borrowing costs for consumers and businesses, which can help economic activity and, in turn, support corporate earnings and company sharemarket valuations. However, central banks must balance this with the risk of inflation flaring up again. So far, their tone has been cautious: the Fed and others have signalled they will monitor data closely and adjust policy as needed.

Bottom line for interest rates and bonds: After a long period of tightening, we are now in a phase of monetary easing, which has been positive for bond investors. Bond prices rose this quarter as yields fell, providing relief and positive returns. For the first time in years, values of both shares and bonds are moving higher together, which is encouraging for diversified investors. Lower interest rates also make financing cheaper, which is generally supportive for share markets (it can boost sectors like housing and reduce pressure on high-debt companies). For the remainder of the year, the expectation of further mild rate cuts is a tailwind for markets - but investors should keep an eye on inflation risks (for example, any price spikes from oil or renewed tariffs) that could alter the course of central bank policy. Overall, the third quarter bond rebound reaffirms the value of holding fixed-income assets: bonds are back to providing income and diversification benefits when shares wobble, helping to smooth out portfolio performance.

Easing trade tensions and divergent commodities

The third major theme of the quarter was an improved geopolitical and trade environment, which lifted market sentiment globally. Earlier in 2025, fears of escalating trade wars weighed on investors - most notably in April, when the U.S. administration announced new tariff proposals on major trading partners. Markets initially dropped on that news. However, the third quarter brought signs of trade peace, or at least a truce. The U.S. put additional tariffs on hold for 90 days, opening the door for negotiations. This pause in trade hostilities greatly calmed investors. By May and June, it became clear that the worst-case trade war scenarios would likely be avoided, and both sides sought compromises. In fact, this quarter saw some tangible improvements: the U.S. and China extended their trade truce, avoiding new tariff escalations. The easing of trade tensions boosted growth forecasts in both the U.S. and China and removed a major overhang of uncertainty from the markets. This was a key reason why investor confidence surged mid-year, fuelling the share market rebound.

Outlook - cautiously optimistic going forward

Looking ahead to the remainder of 2025 and beyond, the overall outlook for investment markets is cautiously optimistic. The strong performance year-to-date has been supported by fundamental improvements and policy shifts that may carry into the final quarter of the year. Monetary policy is now on an easing track: further interest rate cuts from the Fed are anticipated over the next 6-12 months, and other central banks, like New Zealand, may follow suit. These lower rates should continue to support share valuations (as financing costs fall, and economic growth gets a boost) and provide a favourable environment for bonds (since falling yields push bond prices up).

That said, it’s important to stay aware of risks. Markets have rallied strongly and are somewhat “priced for perfection” at these new highs, meaning any negative surprises could cause a pullback. If inflation were to flare up again (for instance, due to higher commodity prices or rising wages), central banks might slow or pause their rate cuts - an outcome that could unsettle both shares and bonds. There is also the possibility of economic growth slowing more than expected.

On balance, however, the positives appear to outweigh the negatives in the current outlook. Inflation is on a downward trajectory in most regions, interest rates are likely to drop further, and the corporate earnings outlook is stable. As always, diversification will remain important: having a mix of asset classes - particularly across shares and bonds, and across international markets, which can help manage any bumps in the road.

By staying diversified across asset classes and regions and focusing on your own financial goals and risk tolerance, you’ll be better positioned for whatever the future brings. The key message of the past quarter is stay informed, stay balanced, and keep a long-term perspective to help navigate the markets ups and downs.

If you have questions about your investments, savings or retirement plans, please contact your financial adviser or AMP for a little help.

Market summary

The second quarter of 2025 has been a turbulent one, with markets around the world experiencing sharp ups and downs. This is a timely reminder of why it’s so important to have a well-diversified investment portfolio. Markets can shift quickly, and trying to constantly adjust your investments to keep up is incredibly difficult. That’s why staying focused, avoiding knee-jerk reactions, and sticking with a balanced, long-term strategy is often the smarter approach - rather than chasing trends or reacting to every new worry.How have AMP funds fared?

Growth assets, such as equities, performed exceptionally well throughout the quarter, with no negative returns recorded. Our portfolios, which are 60% hedged to New Zealand dollar, benefited from the strengthening of the New Zealand dollar. All AMP named funds achieved positive returns, with the more aggressive risk profiles yielding returns of over 5%. This demonstrates the value of diversification and maintaining investments, especially considering the market upheaval in April.For more insight into our investment approach and fund performance, click here: How we invest | AMP New Zealand

Market overview

United States: Despite ongoing policy changes, US share markets remained strong. The S&P 500 rose by 6.3% in June - its best monthly gain since November 2023. Technology stocks led the way, with Industrials and Consumer Discretionary also up more than 8% for the quarter. Defensive sectors like Health Care lagged behind.The bond market faced pressure after Moody’s downgraded the US credit rating in May, pointing to growing concerns about government debt. Investment-grade corporate bonds returned 0.2%, while high-yield bonds did better at 1.7%. The Federal Reserve kept interest rates steady at 4.25–4.50%, noting that while the economy remains solid, there are rising risks of inflation and job losses.

Europe: European markets had a good quarter, helped by stronger business confidence, especially in Germany. The European Central Bank cut interest rates twice, lifting investor confidence. UK markets also performed well.

Emerging Markets: Emerging markets delivered strong returns. Eastern Europe and China benefited from upbeat economic forecasts and progress in artificial intelligence. Brazil and South Africa also made gains, while India and Taiwan underperformed.

Key Developments

Trade Policies: A key theme this quarter was shifting trade policy. The US paused several tariffs for 90 days, easing tensions and boosting hopes for US-UK trade deals and lower tariffs with China. These moves helped raise growth forecasts for both countries. However, concerns about a broader trade war and supply chain risks remain.Economic Indicators: The US economy started the year in good shape, with early data showing minimal impact from tariffs. Still, rising inflation and falling business and consumer confidence are challenges. A new tax bill extending the 2017 tax cuts has raised concerns about growing national debt, which put pressure on the bond market.

In New Zealand, the economic outlook was mixed. Unemployment stayed at 5.1% in Q1, but wage growth was weaker than expected. The Reserve Bank cut interest rates by 0.25%, with more cuts possible. The Government’s Budget set a path to reduce deficits and return to surplus by June 2029.

Investor confidence boosts global markets in May

Investor confidence improved in May, helping global share markets bounce back. The S&P 500 rose 19% from its April lows, nearing record highs. Better-than-expected U.S. earnings, especially in the Communications Services sector, and positive trade news supported this rally.What we’re watching

As we move forward, markets are likely to remain sensitive to new developments in trade policies and economic indicators. The evolving geopolitical landscape and policy shifts will continue to influence market dynamics. Investors would be wise to stay informed and maintain a steady investment plan to navigate the uncertainties ahead.Summary

In conclusion, the past quarter has been marked by significant market movements and policy changes. While challenges remain, maintaining a long-term perspective in a diversified portfolio can help investors navigate market turbulence and achieve long-term goals. Trusting market resilience and a well-executed strategy is crucial amid volatility.Thank you for reading our market commentaries. For assistance with your savings goals or any questions, please contact your adviser or AMP for support.

Quarterly Market Update: 31 March 2025

The first three months of 2025 was a period where returns were mixed across the various investment markets within our AMP funds. In this update, we summarise the major changes in markets and economies since the start of the year, and provide some insight into how AMP is managing your investments and savings amid some interesting times.

Market Summary

United States: The US sharemarket experienced a decline in the first quarter following two consecutive years of gains exceeding 20 per cent. The year began on a strong note, with the S&P 500 reaching a new all-time high in mid-February. However, sentiment shifted late in February due to rising policy uncertainty in Washington, leading to a decline in the S&P 500 by the end of the quarter. Early in April, President Trump announced unexpected tariff measures, which further unsettled investors and led to additional market declines.

Europe: On the other hand, European markets saw a boost thanks to Germany's new spending plans and a more positive business outlook. Sharemarkets rallied, particularly in Germany, due to optimism around the new administration. The European Central Bank cut interest rates twice, and UK shares performed well.

Emerging Markets: Emerging markets had a good quarter, with the MSCI Emerging Market index gaining ground. Eastern Europe and China did well, driven by positive economic outlooks and AI optimism. Brazil and South Africa also saw gains, while India and Taiwan struggled somewhat.

Asian markets outside Japan saw modest gains, led by China, Singapore, and South Korea. China’s government stimulus measures helped stabilize the economy, but Taiwan and India faced declines due to trade concerns.

New Zealand: In New Zealand, GDP growth posted for the last quarter of 2024 had a positive uptick, technically bringing the country out of recession. The Reserve Bank of New Zealand started cutting interest rates and the market is now expecting a neutral official cash rate from the Reserve Bank to be around three per cent. However, the NZ sharemarket was one of the lower performing markets around the world in the first three months of the year.

How is AMP positioning portfolios during this period?

One of the big global themes we have been thinking about for some time is geopolitical fragmentation and economic competition. We’ve been tracking this theme since the commencement of the Ukraine war and the strategic competition between the US and China increased. Globalisation is being rewired as the world splits into competing blocs.

Over the past two years, we have been gradually bringing even more diversification into the AMP diversified funds, as we have considered the changing geopolitical landscape, as well as other themes such as digital disruption and AI, changing global demographics and climate change.

Equities: Last year we shifted some allocation from developed market equities, like the US, to emerging markets and listed infrastructure and a small allocation to direct infrastructure. Considering tariffs and the effects of deglobalisation, we think these factors are inflationary over the medium and long-term horizon. Even before the Trump administration and the introduction of tariffs, we were already concerned about persistent inflation and higher-for-longer interest rates. The addition of trade wars and tariffs has only heightened this concern.

Fixed income: Previously, we added NZ and US inflation linked bonds to the AMP diversified funds, which have outperformed nominal bonds on a year-to-date basis. This move was to increase the diversification and granularity of fixed income exposures.

These particular moves continued to deliver strong returns when the market was going up, but importantly, they are now providing additional diversification during this current period of volatility.

We review our mix annually, at a minimum: We have just reviewed our asset allocations for the AMP diversified funds – that is, the mix between shares, bonds, cash and infrastructure, as well as our mix between countries and geographies.

At this point in time, we do not believe we need to make major changes to our current allocations, primarily because our diversified funds are already positioned well with increased diversification that we have added over the past couple of years.

We are seeing further diversification opportunity in adding more to high yield bonds, and we see keeping our growth allocation at benchmark level as sensible, given the heightened level of uncertainty. Our changes are likely to be modest because we have already made changes that will help us, based on a longer-term view of the global economy and markets.

What we’re watching: We are paying close attention to the global impacts of tariffs and trade wars. If needed, we will make further changes to our asset allocations as required, based on our view on where we believe markets will be looking out 5-years from now. With economic and investment forecasts, the further you look out, the more confident you can be with the view. Trying to predict what will happen in the next few months, or the next year, comes with a lot more unpredictability, therefore increased risk of getting those calls wrong.

Diversification remains key: Our investment philosophy and investment strategy is designed to maximise the benefits of diversification. We think we probably have the most diversified funds in the KiwiSaver market – today, the AMP KiwiSaver Balanced Fund has approximately 6,800 individual holdings in it. A search on portfolio holdings of diversified funds within KiwiSaver funds in the market shows varying levels of diversification, but the AMP funds compare very well. Right now, we’re happy we have this increased diversification to help our customers. When markets are volatile, diversification is your best friend.

In summary

Global equity market volatility can be challenging, but investors who stay the course and adhere to sound investment principles are more likely to achieve their long-term goals. By maintaining a long-term perspective, diversifying investments, rebalancing portfolios, and seeking financial advice, investors can navigate the turbulence with confidence. Ultimately, staying the course amid market volatility is about trusting in the resilience of markets and the power of a well-executed investment strategy.

Thank you for reading our market commentaries. For help or advice with your savings or investments goals, please contact your adviser or our team at AMP.

Managing ups and downs webinar questions

Following our live webinar on 10 April, we share the top eight questions asked by our members, along with answers from our experts. The full webinar recording is also available on this page.

A strong finish to 2024 for savers and investors

Strong returns to end 2024 - AMP KiwiSaver Scheme diversified funds delivered another solid quarter, capping off a year of returns well above long-term expectations.

Markets overcame global uncertainty - Despite headlines around inflation, geopolitical events, and economic growth concerns, investment markets remained resilient.

Looking ahead - Key trends like AI, demographic shifts, and market diversification will shape future opportunities. Staying diversified remains essential.

Need help? - If you have questions about your KiwiSaver or investments, our team is here to support you.

Over the last quarter of 2024, savers and investors enjoyed another very strong period of positive returns in their funds. This capped off an excellent year for 2024, with returns being well above long-term averages and expectations.

The AMP KiwiSaver Scheme diversified funds delivered returns between 1.76% for the AMP Conservative Fund, and 6.43% for the AMP Aggressive Fund, during the period from 1 October to 31 December 2024. Over the full year, the range was 9.46% for the AMP Conservative Fund to 20.01% for the AMP Aggressive Fund. All returns are after fees, but before tax. The largest fund in the AMP KiwiSaver Scheme, the AMP Balanced Fund, produced a 13.86% return over the year, after fees.

Over the course of the year, and continuing in the last quarter, there was no end of headlines and news that might make casual observers believe that global events would have a negative impact on investment returns. Geopolitics, regional conflicts, inflation, growth concerns and changes in global leaders provided plenty of headlines. As regularly discussed in our commentaries, we urge our customers to look through short-term ‘noise’ and focus on the long-term. The last few months of 2024 was another good example of why this is an important message for savers and investors to remember.

During the last quarter of 2024, three key themes were on our minds:

1. US election of President Trump

In the United States, the re-election of President Trump and the Republican Party's control of both chambers of Congress boosted investor expectations for a more business-friendly environment, including deregulation and tax cuts. This resulted in US sharemarkets rallying and posting double-digit returns. For the year, the “Magnificent 7” companies dominated as the group accounted for 53.1% of the S&P 500’s 2024 total return with annual gains by Apple (+31%), Nvidia (+171%), Microsoft (+13%), Amazon (+44%), Meta (+66%), Tesla (63%), and Alphabet (+36%).

The Federal Reserve lowered interest rates by 0.25% in both November and December. While this would normally be positive for bond markets, they did not fare as well, as markets are now pricing in fewer interest rate cuts for 2025 amid fears that Trump’s policies could be inflationary.

2. Divergent growth paths within global markets

Global growth showed varying trends across different regions.

Sharemarkets across Europe generally declined near the end of 2024 amid fears of recession. Poor growth from Germany and France dominated market sentiment, while political uncertainty in Germany added to the challenges. The European Central Bank (ECB) cut interest rates by 0.25% in both October and December. ECB President Christine Lagarde signalled more cuts to come in 2025, saying the “direction of travel currently is very clear” as the single currency area wrestles with lacklustre growth.

In contrast, Japan’s sharemarket posted a healthy gain for the quarter as the Bank of Japan declined to raise interest rates in December citing inflationary pressures as the economy continues to rebound.

China's government announced numerous stimulus measures but negative sentiment regarding the potential impact of tariffs from the Trump administration dampened sharemarkets. China’s economic growth remains lacklustre (relative to expectations) despite significant stimulus measures. However, these measures have not all been implemented yet and the impact has so far been very limited.

There are different growth scenarios playing out across different regions, therefore maintaining a well-diversified portfolio will be important as regional differences emerge.

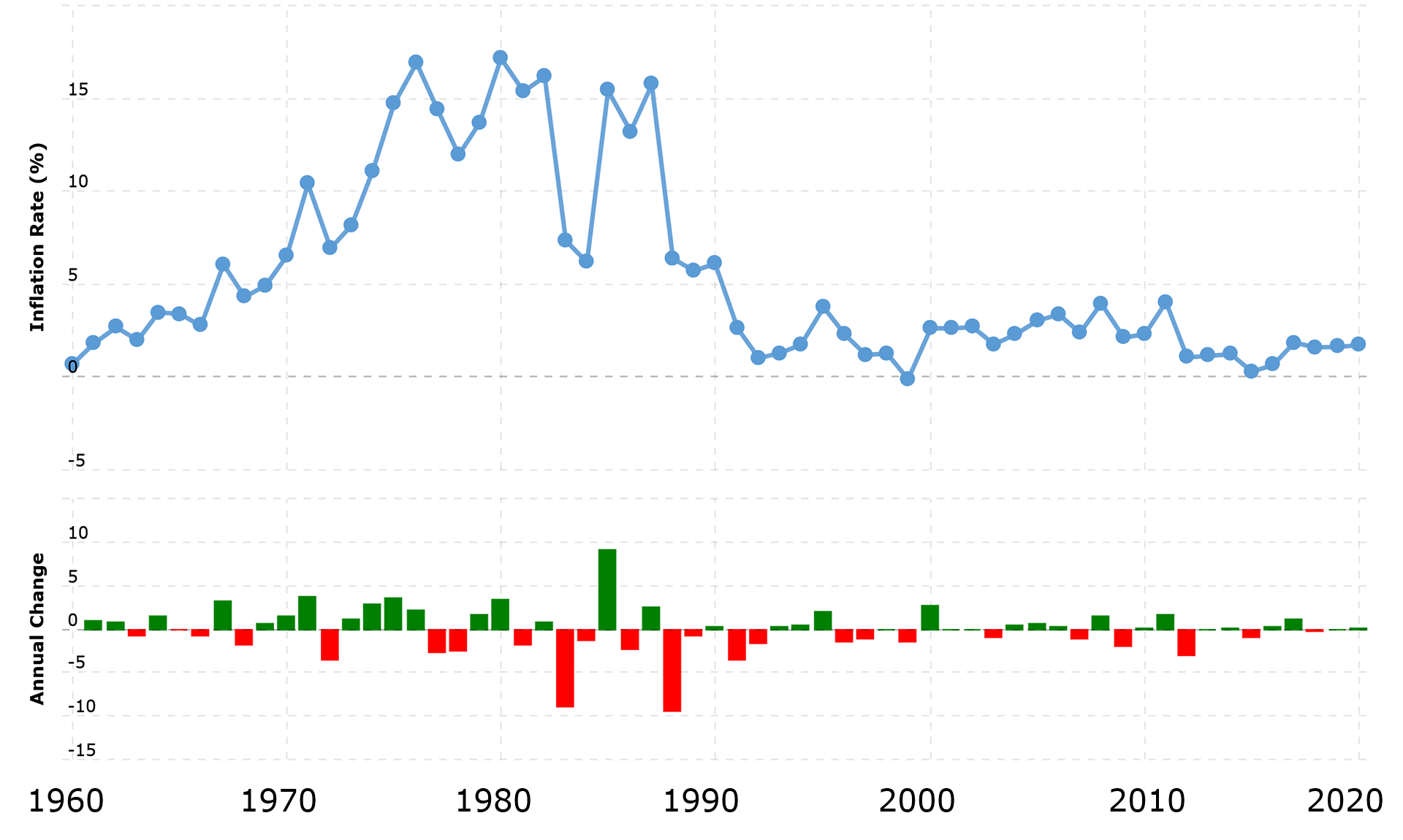

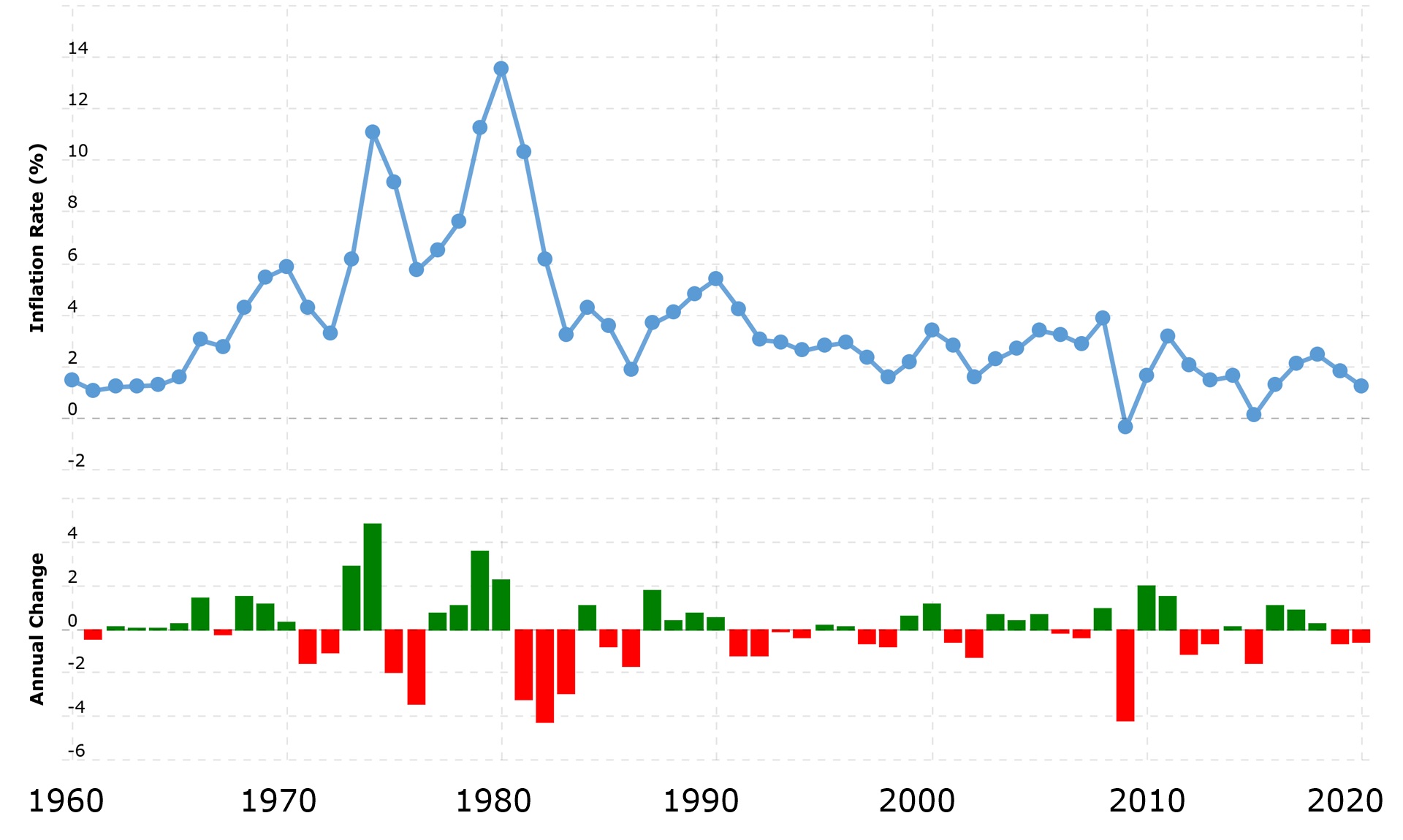

3. Global inflation remains persistently sticky

Throughout 2024, we have argued that inflation will remain higher for longer – contrary to many commentators and how markets were pricing inflation risk. Now it seems that most are now accepting that inflation is not going away easily.

In the US, ongoing concerns about inflation and fiscal sustainability led to a broad sell-off in the bond market. Bonds were one of the few asset classes where performance came under pressure during the quarter.

In Europe, high inflationary pressure limited the ECB's ability to inject stimulus into its economy by cutting interest rates further and it is expected that the ECB is in ‘wait and see’ mode. At this point, it is a trade-off between persistent inflation and subdued economic growth.

In New Zealand, inflation is back within the 1-3% target band for the Reserve Bank, enabling our central bank to reduce the Official Cash Rate to address slowing economic conditions. Whilst this enables the Reserve Bank to cut rates to stimulate growth in the economy, we continue to remain susceptible to global price inflation and the NZ Dollar weakened over the quarter against the US Dollar, making it more expensive to import goods.

Outlook

Predicting the future is always fraught with risk. It’s always easy to think about the risks ahead – and they are always present. However, the further out you look, the more confident you can be with your views.

We think that there are a number of transformative changes occurring that provide opportunities for the economy, markets and ultimately savers and investors in the markets. Economies are being transformed by mega forces such as Artificial intelligence (AI), geopolitical fragmentation and aging populations. We see long-term economic trends being reshaped by these forces now.

AI will continue to deliver benefits, and we expect that the benefits will broaden out from the ‘Magnificent 7’ as more businesses and companies generate benefits from AI. We think the AI investment opportunity will continue to first play out in the US sharemarket, where more technology-supported businesses are listed.

There is a lot changing in the world at present. But is this any different to other times in the past? Falling leaves make the way, but the key, as always with investing, is to retain good diversification and make sure your fund is aligned to your risk profile.

As always, if you need a little help with your investments or savings, please make contact with one of our team.

Summary

Despite a challenging start to the quarter, major asset classes ended in positive territory, with markets showing resilience amid a 10% drop in the S&P 500 in early August.

Global markets have been navigating mixed signals, with US inflation cooling and central banks, including the Federal Reserve and the European Central Bank, cutting rates. However, concerns about recession risks and geopolitical tensions persist.

New Zealand’s economy remains under pressure with near-flat GDP growth, though the Reserve Bank has begun easing monetary policy, and the NZ dollar saw a significant rise.

Our diversified portfolios have been strengthened with new allocations, including Global Listed Infrastructure and renewable energy investments, helping to protect against inflation and market volatility.

We live in interesting times! Despite an almost ten per cent drop in the S&P 500 Index (the broad US stock market index) in early August, most major asset classes ended the quarter in positive territory with new all-time high records along the way.

Around the world

A combination of weaker US economic data and an unexpected interest rate hike by the Bank of Japan saw investors re-evaluating risk. This resulted in a sell-off in equities causing equity market indices to fall. At the time, the balance of opinion swung from expectations of a US economic soft landing to that of real fear of a recession in US economic growth. Markets are now priced for a soft landing with economic data supporting the soft landing thesis.

At the start of the quarter, inflation was very much the focus for global markets and most central banks maintained restrictive monetary policy in efforts to combat inflation. For now, inflation is declining, growth in wages in the US is moderating and labour market pressures are cooling. Importantly, 14 months on from its last interest rate hike, the Federal Reserve has begun easing monetary policy with a 0.50% interest rate cut in September.

US Corporate profit reporting season showed that the sector was resilient and earnings growth consensus estimates shows that this should continue. US Treasury yields, and indeed interest rates globally, fell sharply during the third quarter resulting in positive returns for bonds.

In Europe and the United Kingdom, economic prospects are brightening after a period of slow and near recession conditions. Moderating inflation in Europe also allowed the European Central Bank to cut rates. The outlier here is Germany, where its industrial sector is struggling due to its reliance on China and its auto sector which has fallen behind in the shift to electric vehicles. In the United Kingdom, the third quarter of this year saw its economy showing signs of life. Growth in the UK has been stagnant since the end of COVID-19 lockdowns. Consumer and business confidence is on the rise, and declining inflation allowed the Bank of England to also cut interest rates.

In Japan economic performance remains patchy. Although business confidence is rising, growth remains weak, and household spending is constrained. The Bank of Japan has an interesting history for the past 30 years of raising interest rates and tightening monetary policy in anticipation of inflation. The Japanese yen has historically been very cheap and one of the driving factors was the prevalence of a carry trade in the currency. A carry trade is where an investor borrows money in a currency where there is a low-interest rate environment, and then proceeds to invest that money in another currency with a higher interest rate environment. What makes the trade successful is a depreciating or stable currency. The surprise interest rate hike by the Bank of Japan led to rising Japanese interest rates, resulting in repricing of the carry trade and its subsequent unwinding during July and August, as the yen appreciated versus the US dollar.

China’s economic performance over the quarter has failed to fire and its property market problems remained unsolved, negatively impacting consumer confidence and credit growth.

New Zealand

Gross domestic product (GDP) growth has been almost nil since September 2022 and the Reserve Bank of New Zealand (RBNZ) has finally let its foot off the brakes and began its interest rate cutting cycle. Monetary policy, however, is still restrictive while inflation is hovering just above the RBNZ inflation target. In its monetary policy statement, the central bank acknowledged that downside risks to the economy remain, and that it is monitoring conditions and are prepared to act more aggressively if deemed necessary.

In what is good news for importers but bad news for the export industry, the NZ dollar rallied just over 4% to close the quarter out at $0.6345 versus the US dollar.

Portfolio changes

During the last 3 months, we introduced allocations to Global Listed Infrastructure for our diversified funds, to further diversify and strengthen our portfolio. Infrastructure investments have defensive characteristics including; their low correlation with other asset classes and their ability to offer inflation protection. Moreover, our Global Climate Fund made its first private market investment into renewable power opportunities. These investments are now also part of our diversified funds as direct infrastructure investments.

Outlook

As mentioned, US markets are priced for a soft landing, however, this can change in an instant if new data is released that points to negative growth expectations. Where central banks across the globe have now started easing monetary policy, interest rate sensitive assets such as bonds and real estate, could benefit from this.

We continue to monitor the geopolitical situation in the Middle East and the Ukraine, and if it escalates it could have a negative impact on asset prices. The imminent US Election now seems like a close race, and it is not clear how markets might react with either outcome. Tariffs, corporate taxes, fiscal deficits and the independence of the Federal Reserve are all hotly contested issues, so until policies become clearer, and the result is known, it is hard to determine how a Trump or a Harris outcome might impact markets.

Lastly, China has announced sizeable policy stimulus measures across the board. Monetary policy is now more expansive – the equity market and property sectors are benefitting from interest rate cuts and increased liquidity. Broad financing programmes have been announced to assist SMEs as well. This had a sizeable effect on China’s equity market which, at the time of writing, has rallied 27% since mid-September.

We continue to support the case for keeping a long-term view and maintaining good diversification across investment portfolios. These fundamentals are core to our investment philosophy, and we have often talked in these commentaries that it is always important to look through the ‘noise’ that we read about daily. The current environment is not different to others we have seen in the past. History is a great teacher for all investors and savers.

Thank you for continuing to read our market commentaries. We look forward to providing these updates quarterly. As always, if you need assistance with your savings goals or have any questions, please contact your adviser or AMP for support.

Overview:

The second quarter of 2024 was excellent for global markets, delivering exceptional returns for our AMP-branded funds. Corporate earnings and easing inflation drove equity markets to new highs.

Conflict in the Middle East and sticky inflation accounted for periods of investor uncertainty during the quarter. However, strong corporate earnings data provided investors with the confidence to support valuation levels. Adding to investor confidence are the first signs that growth is moving beyond the large-cap technology stocks and is broadening out.

The UK equity market followed global markets and the benchmark FTSE 100 index reached a new high. UK economic growth data and easing inflation is responsible for the market anticipating interest rate cuts.

Asian markets also performed well, and the Chinese market rallied after new measures were announced to revive the struggling property market.

Growing technology advancements driving strong returns

Investors’ enthusiasm for AI and a general preference for high-quality companies has driven technology returns up 30% this year, nearly four times higher than the rest of the S&P 500.

The technology sector has risen 100% since January 2023, while the rest of the S&P 500 saw only a 24% rise during the same period. At this point in time, the full potential of artificial intelligence is not yet realised or imagined and its impact on productivity will only be evident over the long term.

However, what could halt the growth in the technology sector? Regulatory changes pose a potential risk to its rapid growth. The U.S. government focus on regulating AI, particularly concerning ethics and control, could limit its adoption and potential to keep supporting tech. Although regulation is in its early stages, given the potential impact on the sector it would be wise to monitor these developments.

Inflation continues to put pressure on interest rates

Some central banks started to cut interest rates in Q2, led by the Swiss Central Bank, Sweden, Canada and the European Central Bank (ECB). In contrast, the Bank of England left rates unchanged at a 16-year high of 5.25%, and the Federal Reserve has kept rates unchanged in the 5.25% to 5.5% range. Persistent supply constraints are creating ongoing inflation pressure, keeping policy rates above pre-pandemic levels and growth below.

In New Zealand, the RBNZ is holding the official cash rate steady with no sign as to when interest rates will drop. Inflation is proving to be more persistent than what markets would like and until such time that there are clear indicators that inflation is easing, the RBNZ is expected to hold its monetary policy setting.

Fixed income

Today is a different world for fixed income investing compared to pre-pandemic times. After historic central bank rate increases, almost 86% of global fixed income assets now offer a return of 4% or more. This is significant growth when compared to the less than 20% in the decade leading up to the pandemic. Higher yields mean bonds provide more income cushion for investors. However, due to macro volatility and geopolitical tensions, quality assets are preferred and developed markets have experienced investor inflows.

Outlook

Lack of a clear direction on inflationary pressures and economic growth, uncertainty around global election outcomes, U.S. domestic policy, geopolitical conflict, and global inflation is expected to continue to affect investor behaviour over the short term. In addition, the low levels of growth in Europe, the UK and French elections could drive uncertainty that could impact markets in the short-term.

Thank you for continuing to read our market commentaries. We look forward to bringing these to you quarterly, and as always, if you need a little help with your savings goals or have any questions, please contact your adviser or AMP for a little help.

Overview

Strong start to 2024: The first three months of 2024 brought excellent returns for investors in AMP-branded funds, building on a strong 2023. Share markets surged globally due to decreasing price pressures, strong US corporate earnings, and expected interest rate cuts, leading to positive returns for customers.

Global market performance: The US market rose by 10.3%, its best first-quarter performance in five years. Europe saw over 7% growth, while Australia gained 5%. Japan stood out with nearly 20% growth, aided by corporate reforms and a weakened yen.

Investment strategy review: AMP reviews its strategic asset allocation annually to ensure portfolios are positioned well for future market conditions. This involves analysing risk and return expectations over the next five years.

Interest rate cuts expected: Central banks, including the Federal Reserve, are expected to begin lowering interest rates, with three cuts anticipated for 2024. This expectation is based on declining inflation globally and resilient economic growth.

New Zealand economic challenges: New Zealand's economy faces ongoing price pressures, with inflation yet to reach target levels. Economic growth has contracted, leading to concerns. Interest rate cuts in New Zealand may lag behind global peers, with the Reserve Bank expected to act cautiously based on economic data.

Summary

The first three months of 2024 delivered excellent returns for customers invested in our AMP-branded funds, continuing the momentum from a strong 2023. Global price pressures continuing to subside, a strong US corporate earnings season, and the prospect of interest rate cuts have pushed share markets higher, delivering positive returns for customers. To illustrate the strong start to 2024, this chart shows the returns of the AMP diversified funds over the past three months.

Strong investment returns in Q1

The start of 2024 kicked off on a positive note with strong returns across the board, particularly out of the US, with the broader share market finishing the quarter up 10.3% - its best first-quarter performance in five years. The enthusiasm in the market came amid a strong corporate earnings season, expectations of future interest rate cuts, inflation continuing its downward trend, and economic growth remaining surprisingly resilient. The latest economic data is supportive of the rhetoric that the US economy can achieve the Federal Reserve’s desired ‘soft-landing’ outcome, or even better, no ‘landing’ at all. This is a good outcome for investment markets, and subsequently, customer returns.

Strong investment returns over the quarter weren’t just limited to the U.S. The European share market finished the quarter up over 7%, while Australia performed well with a 5% gain. New Zealand continued to lag behind its larger developed global peers with a gain of around 3%, while China’s share market managed to eke out a small gain following the announcement of further Government measures to stimulate the economy. Japan’s share market delivered exceptional returns, up close to 20% for the quarter, as recent corporate governance reforms have resulted in an increase in company shareholder returns, alongside the Yen hovering at its lowest level in nearly 30 years, which makes foreign investment into Japan more appealing, combined with boosting Japan’s export income.

Relative to our peers in the KiwiSaver market, overweight exposure to Global Equities benefitted the returns of our diversified portfolios over the quarter, as did the inclusion of NZ Corporate Bonds and Inflation Linked Bonds. Our greater foreign currency exposure also provided additional support, given the drop in the New Zealand Dollar.

We are currently in the process of reviewing our strategic asset allocation, a task we undertake on an annual basis in conjunction with our investment partner, BlackRock. This review involves analysing the risk and return expectations of various asset classes over a 5-year period to ensure the AMP diversified portfolios are positioned appropriately for our expectations for the future market environment.

Interest rate cuts on the horizon

A strong catalyst for recent market gains has been the expectation that Central Banks will soon begin lowering interest rates. The Federal Reserve is widely expected to begin cutting interest rates in late Q2 or early Q3, with a total of three cuts pencilled in for 2024. Recent commentary by the European Central Bank and the Bank of England have also boosted market sentiment, supporting the narrative that borrowing costs will decrease in 2024.

The expectation of interest rate cuts on the horizon, along with recent comments from Central Banks, are a sign that inflation data globally is continuing its downward trajectory. Inflation targets differ between countries, however, what is common is the fact that inflation has been moving in the right direction. Annual inflation in the U.S was sitting at just 3.1% in February, while in the UK it was 3.4% - far lower than the levels experienced in 2023. Market sentiment has also been supported by resilient economic growth numbers and a strong labour market.

Generally, the markets expectations of interest rate moves are now broadly in-line with Central Bank forecasts. Heightened market movement can often occur when the markets expectations aren’t met, therefore having similar expectations is helpful. The expectations of interest cuts have been priced into the market, which has supported the investment returns experienced during the first quarter of 2024.

Over the past two years, Central Banks around the world have tightened monetary policy, by increasing interest rates, to levels not experienced in decades. Central Banks have also made it clear that interest rate decisions going forward will be made utilising the latest available data, which will need to clearly show inflation is under control. A current concern is the risk of inflation re-surging when rates are lowered, therefore we don’t expect central banks to cut rates before they are confident inflation is going to remain on its downward trajectory.

New Zealand economy

The timeline for interest rate cuts in New Zealand is possibly going to lag global peers, as the economy continues to face ongoing price pressures. The latest inflation data shows that while inflation is on its way down, non-tradeable inflation, otherwise known as domestic inflation, remains elevated. The Reserve Bank of New Zealand will want to see inflation make more significant movement towards the 1-3% target range before beginning to lower interest rates. Based on the latest forecasts, the RBNZ sees inflation returning to the target range in the September quarter this year.

Along with elevated levels of inflation, economic growth in New Zealand is a challenge. The economy contracted in the last quarter of 2023, meaning that New Zealand is in a technical recession – defined as two consecutive quarters of negative growth. This comes despite the country experiencing near-record levels of net migration, with a net gain of 126,000 people last year. Based on the Reserve Bank’s forecasts, an interest rate cut isn’t expected until 2025, but this has the potential to change as further economic data becomes available.

Market Outlook

Looking forward to the rest of 2024, the beginning of the cycle of interest rate cuts in major developed economies could be positive for investment markets. It is expected, however, that central banks will take a more cautious approach to lowering interest rates, utilising the most up-to-date data available. To avoid inflation re-surging, only when central banks have confidence that inflation is on the right trajectory will they decide to cut rates.

Global economies will experience different interest rate paths from one another. This is why we believe it is important to have a well-diversified portfolio and to focus on your long-term objectives. These considerations are all a part of our strategic asset allocation review process that we are currently undertaking; to position our diversified portfolios for the potential market environment based on our future forecasts.

Thanks for reading our first market commentary for 2024. We look forward to continuing to bring these to you regularly throughout the year, and as always, if you need a little help with your savings goals or have any questions about your savings or investments, please contact your adviser or AMP for a little help.

2023 Market Review

2023 was a very good year for global share and bond markets which finished the year higher, delivering healthy returns for investors and the customers in our AMP diversified funds.

This market performance translated into strong returns for customers over the year. For the 12 months ending 31 December 2023, the AMP KiwiSaver Scheme diversified funds produced the following returns (after fees and before tax):

• AMP KiwiSaver Conservative Fund: 7.92%

• AMP KiwiSaver Moderate Fund: 9.25%

• AMP KiwiSaver Moderate Balanced Fund: 10.64%

• AMP KiwiSaver Balanced Fund: 12.07%

• AMP KiwiSaver Growth Fund: 14.15%

• AMP KiwiSaver Aggressive Fund: 14.94%

Markets were strong across the board

In the first half of the year, share market returns were largely driven by a select number of large technology companies in the US, benefitting from the widespread enthusiasm for artificial intelligence (AI) following the meteoric rise of Chat-GPT. The increased interest in AI saw the US technology-heavy NASDAQ index surge over 31% for the first half of 2023; its best first half return in 40 years.

In the second half of the year, investment returns were more linked to inflation expectations, expected changes in interest rates, and the economic outlook for 2024. Despite higher interest rates impacting share markets, other diversified portfolio sectors such as cash investments and short-term bonds offered attractive returns for diversified investors benefitting from the higher interest rates offered.

Overall, investors had a lot to be happy about in 2023. The US share market finished the year with a gain of more than 24%, while in Europe the share market was up nearly 17%. Closer to home, the Australian share market finished 2023 with a 12% increase, as New Zealand lagged somewhat, up approximately 3% over the year.

Returns from emerging market economies lagged that of developed markets, as China failed to experience the economic recovery it had anticipated. Lower than expected global trade demand, ongoing tensions with the US, and concerns over debt levels in the property sector saw the China share market fall over 10% for the year.

For the AMP diversified funds we manage, the asset allocation decisions we made at the beginning of the year have overall made a positive impact for our customers. Overweight exposure to global shares benefitted our returns in 2023, as did our allocation to New Zealand inflation-linked bonds. Having greater foreign currency exposure in our portfolios also benefitted returns due to the drop in the New Zealand Dollar during the year.

Inflation and interest rate pressures

Investment outcomes in the second half of the year were largely centred around the inflation and interest rate story, and how it all looked heading into 2024. Globally, the latest inflation numbers show that the rate of price increases for key goods and services has possibly reached its peak and is now slowly starting to return to target levels – a hopeful sign for investors.

As inflation pressures in the economy begin to subside, so too has the aggressive stance central banks have taken on interest rates. In most major developed economies, central banks have indicated that interest rates may have peaked or are near their peak, as the conversation shifts away from when the next interest rate increase will be to when central banks may start cutting rates. Higher interest rates often put downward pressure on the value of companies, so this change in rhetoric has been supportive for investment returns in the second half of the year.

Whilst the ongoing uncertainty over the direction of interest rates has confused share markets in 2023, it has more directly impacted the bond market, which investors often look at to make judgements about the economic outlook. As an example, in 2023 we saw the yield on the 10-year US Treasury bond, which is often regarded as a proxy for many other important financial matters like future economic growth, jump to levels not seen in 15 years, putting downward pressure on bond and company valuations. In the later part of 2023, as central banks began discussing cutting rates, the yields on these bonds declined. This has benefitted the performance of the share and bond markets, and ultimately returns for customers.

Focusing on the long-term

2023 has been a great year overall for investment returns across the board, but that doesn’t mean returns have all been in one direction. There have been several events during the year that caused short-term disruption to markets, but in the end, the overall impact of these events was minimal, with most markets performing better than expected. This is why we regularly remind our customers to avoid getting caught up in the short-term news or emotive responses, and instead focus on the long-term.

There were a multitude of events throughout 2023 that had to be traversed by the markets, but the overall trend is upward. Markets experienced the collapse of some regional banks in the US, surprise interest rate decisions by central banks, war breaking out in the Middle East, and bond yields hitting 15-year highs, but looking at the year, the global share market returns were still strong.

Although it can be unsettling to see your investment balance move around, short-term movements are normal and a part of investing. Although it is only one year, this chart is a good reminder of the ups and downs in investment markets, and why it is important to always focus on your longer-term savings and investment objectives, and avoid getting caught up in the short-term news and market events.

2024 will no doubt bring its own set of challenges and opportunities, as does any other year in investment markets, so having a well-diversified portfolio and focusing on your long-term objectives will be just as important.

Thank you for continuing to read our market commentaries. We look forward to bringing these to you regularly in 2024, and as always, if you need a little help with your savings goals or have any questions, please contact your adviser or AMP for a little help.

Quarterly market commentary

Investment returns from share and bond markets eased during the September quarter, losing some of the momentum experienced in the first half of the year. Despite this, overall returns since the start of 2023, and over the past 12 months, remain positive for our diversified customers.

Diversification is always key

Overall, it was a difficult three-month period for markets. The projection of interest rates staying higher for longer caused a jump in bond yields to decades-long highs, putting downward pressure on share market valuations, bond valuations, and the outlook for growth companies.

Although parts of share markets are negatively impacted by higher interest rates, other portfolio assets offer attractive returns for diversified investors. The benefit of higher interest rates are the interest rates available on short-term bonds and cash investments in the market. It also means investors now demand greater returns for longer-term investments, so newly issued bonds provide a potential higher long-term rate of return for investors.

As interest rates increase, so too do the interest rates available on cash investments. As an example, the current running yield on the AMP cash fund is 5.7% before fees and tax. As a diversified investor, having allocations to different asset classes will mean exposure to different opportunities in markets. The asset allocations for our diversified funds are designed to navigate through multiple investment and market cycles, which is very important for customers saving for retirement and managing retirement savings.

A summary of the last three months

Following a great six months to start off 2023, global share and bond market returns retracted over the past three months, as investors come to the realisation that the new economic period we are entering means interest rates will remain higher for longer.

This realisation was further underlined by the US Federal Reserve’s comments at its latest meeting, projecting another possible interest rate increase and no rate cuts until the second half of 2024. This sentiment contributed toward the US share market finishing the quarter lower, as investors begin to realise that central banks aren’t going to come to the rescue as the economy slows with interest rate cuts as they have done in the past.

The European markets were also down over the quarter as Europe continues its fight against inflation, while in Australia, the share market performed better relative to most of its developed market peers.

The economic recovery in China continued to stutter over the quarter, while the share market was weighed down by a lack of consumer demand and worries over the level of debt in the property sector. There are, however, some positive signs that China's economy is beginning to stabilise through the recent Government stimulus measures that have been put in place.

The New Zealand share market fell more than many other global markets over the quarter, while the NZ Dollar continued its 2023 trajectory, down against the USD over the three-month period. A falling NZ Dollar helps returns on offshore investments that are unhedged, so this provided some ballast to portfolios to the extent they are unhedged. Although, the news of stronger-than-expected GDP numbers, a bounce back in dairy prices, and the initial signs that the Chinese economy is stabilising, present more positive local news.

Outlook

It's important to recognise that there hasn’t been a large shift in the underlying fundamentals of investment markets over the quarter. The first half of 2023 delivered great returns for investors, and when this happens it’s normal for markets to take a breath as investors take profits. This is what we experienced throughout the quarter.

The view that interest rates will remain higher for longer, is a view we have held for the past year and has not changed. We believe we are in a new economic regime of higher interest rates and where inflation will settle above recent historic levels.

Over the quarter we have also seen the latest economic data supporting the view that labour markets are sustaining growth despite headwinds in global economies. Add this to strong consumer spending and volatile oil prices, and it leads to a difficult time for central banks in their fight against inflation. It is becoming clearer that the recent interest rate increases are constraining economic activity and reducing inflationary pressures to some degree, but keeping interest rates high is needed to keep bringing inflation back down to target levels.

Heading into the remainder of 2023, the upcoming US corporate earnings season will be an important period, providing insight into how companies around the world are holding up amid the current market environment, and importantly, the future outlook.

In New Zealand, the upcoming election will likely add to market sentiment depending on the outcome, while house prices are expected to modestly increase after reaching their bottom earlier in the year.

If you have any questions regarding your savings and investments, make sure to reach out to your adviser, or contact AMP for a little help.

Quarterly market commentary

Summary

The June quarter delivered healthy returns for investors, with global share and bond markets generating positive gains over the three months. The completion of June marked the end of the first half of the year, producing great investment outcomes for customers in the AMP diversified funds. To illustrate the strong growth in markets this year, since 1 January 2023, the AMP KiwiSaver Balanced Fund has returned 7.9% after fees, while the AMP KiwiSaver Aggressive Fund returned 10.7%.

Great quarter for investment returns

The past three months saw the majority of global share and bond markets deliver healthy returns, continuing the momentum from the first quarter of 2023. Technology, and more specifically, Artificial Intelligence, was the hot topic of markets, off the back of widespread enthusiasm following the meteoric rise of ChatGPT. Big rallies in large tech companies like Apple, Microsoft, Meta, and Nvidia pushed the US technology-heavy NASDAQ index to surge 31.7% for the first half of 2023 – its best first-half return in 40 years.

The rally in the technology sector led the broader US share market higher, gaining 8.7% for the quarter, while in Europe the share market was up 2.8%. Closer to home, the Australian share market gained 1%, outperforming the New Zealand share market which lagged behind with a quarterly gain of 0.3%. Returns from emerging market economies lagged developed markets, eking out a small gain over the quarter, with China’s share market weighed down by ongoing tensions with the US and concerns about the country’s economic recovery.

Overall, it was a strong quarter for investment markets, and the customers invested in our AMP funds. The AMP KiwiSaver Balanced Fund generated a return of 3.7% for the quarter, with the AMP KiwiSaver Aggressive Fund up 5.4% for the three-month period.

Overweight exposure to global equities benefitted the returns of our funds over the quarter, as did our allocation to New Zealand inflation-linked bonds. Also, having greater foreign currency exposure in our funds helped given the NZD fell during the period.

Over the quarter we implemented our annual strategic asset allocation review, which resulted in the introduction of NZ Corporate Bonds to our more income-focused diversified funds. This comes as the current high-interest rate environment offers encouraging fixed-income yields. We believe this will support the returns of the more conservative portfolios as it provides more diversification within our fixed interest allocations, and captures the improved yields available in this market. The completion of this review also saw an increased allocation to US and NZ inflation-linked bonds within our diversified funds, and a reduction in exposure to cash.

Economic data shows inflation is declining

The markets have been keeping a close eye on the myriad of economic data over the past 12-months, to determine the impact of interest rate decisions by central banks on consumers and company earnings.

Recent economic data supports the view that the rate of inflation around the world is beginning to cool, following 12-18 months of high inflation. Lowering rates of inflation has generally seen central banks take a step back from their moves to increase interest rates, to re-evaluate their current positions and assess the impacts of past interest rate rises before making further changes to their settings.

Closer to home, the Reserve Bank of New Zealand (RBNZ) lifted interest rates by 0.25% at its May meeting, taking the Official Cash Rate (OCR) up to 5.5%. However, much to the surprise of many commentators, the RBNZ signalled the OCR had reached its peak at 5.5%. This comes as the New Zealand economy contracted in Q1, the second consecutive quarter of negative GDP growth.

What central banks will continue to focus on will be labour market data, in an effort to gain insight into the tight and resilient job markets. Unemployment data and the most recent job reports indicate that the labour market remains strong, which may force central banks to keep interest rates higher for longer.

Market movements are a normal part of investing

The strong investment gains experienced over the quarter didn’t come without the normal market ups and downs, with a couple of key events causing some uncertainty across markets. One of these was the US debt ceiling which covered the headlines in May, with reports coming out that the US Government would begin to run out of money to pay its debt obligations at the beginning of June unless its debt ceiling was raised.

Although conversations went on throughout the entirety of May, a deal was struck to raise the debt ceiling in early June, allowing the Government to borrow more money in order to ensure no payments were defaulted on. This agreement provided relief to markets, particularly the US bond market, which experienced heightened market movements in the lead-up to the agreement.

Regardless, the markets over the quarter delivered strong returns, despite some of the ‘headlines’. This emphasises our regular view in these commentaries about not getting caught up in the short-term news, which are often negative in nature. Staying the course and focusing on the long-term fundamentals, is what we believe is more important when planning savings and investment goals.

If you have any questions regarding your savings and investments, make sure to reach out to your adviser, or contact AMP for a little help.

Summary

March was another good month for markets to finish off a really positive quarter for investment returns. Investors in all AMP diversified funds experienced healthy returns over the past 3 months – particularly where funds have a higher weighting to growth investments. The AMP Balanced Fund produced a 4.04% return after fees and the AMP Aggressive Fund produced a 4.99% return after fees, between 1 January and 31 March.

Positive month and quarter for global markets and customers

March saw strong returns for many global share and bond markets, as investors shook off a relatively poor February to finish the quarter on a high. Despite the recent struggles in the financial sector, the US share market was up 3.7% for the month to finish the quarter with a 7.5% gain. The European market edged up 0.1% for the month to finish with a quarterly return of 8.7%, while in China the share market finished up 3.8% for the quarter after rising 0.8% during the month.

Despite overseas markets performing well, Australia and New Zealand share markets finished the month lower, down -0.2% and -0.1% respectively. However, a negative month wasn’t enough to stop the markets from posting a positive quarter, up 3.5% and 3.6%.

The recent market uplift has led to a great quarter of investment returns for our customers, with the majority of our AMP branded Diversified funds generating their best quarterly return since 2020.

Our investments into Inflation-Linked Bonds in New Zealand and the United States also added value to our diversified portfolios over the month, with these investments performing strongly, significantly outperforming traditional government bonds.

Diversification is still key for investors

There are few ‘free lunches’ when investing, but diversification is one. Diversification in investment portfolios enables investors to navigate all parts of the investment and economic cycles. For customers invested in our AMP-branded diversified funds, we have over 6300 investments, which means your exposure and risk is spread over thousands of investments.

March was a month where this diversification protected customers when the financial news headlines were dominated by the failure of two medium-sized US banks, causing uncertainty across the financial sector. The US Regulators seized both Silicon Valley Bank and Signature Bank after customers began withdrawing their funds by the billions, resulting in some fears that the banks would not be able to cover all of the withdrawals.

Share markets initially fell on the news with issues also arising in Europe as Credit Suisse began experiencing difficulties. Again, regulators acted quickly, with the Swiss Government stepping in to help arrange a buyout by rival bank UBS. Despite this, share markets recovered quickly and as we said earlier, provided strong returns over the quarter.

Our exposure to these banks within our portfolios was extremely small, emphasising why diversification is key when the unexpected occurs. We value this principle highly at AMP, and it is a key part of our philosophy of managing investment.

Outlook

Our outlook for the remainder of the year remains unchanged from previous commentaries since December 2022. The past few months have produced strong returns for investors after a challenging 2022, which re-enforces our view that remaining invested through all parts of the economic cycle is important to achieve your long-term plans.

Predicting markets over the short term is fraught with challenges, but we have more confidence in the view over the next 5 years that investors will be rewarded for remaining invested and focusing on continuing to contribute to their savings plans.

Summary

The majority of global share and bond markets struggled in February, as January’s rally lost momentum. Some higher-than-expected inflation numbers and signs pointing towards resilient labour markets have investors wary that central banks may keep interest rates higher for longer to wrestle inflation under control.

Although global share and bond markets finished the month lower, the AMP-named funds that we manage performed well relative to most of our peers in the market.

Global markets struggled during February

The market rally in January failed to continue over into the second month of the year, with bond and share markets posting losses for February. From a New Zealand investor perspective, the decline in the New Zealand dollar over the month cushioned the fall in returns for overseas investments that are exposed to currency movements.

The US share market dropped 2.4%, with the energy sector experiencing the largest decline. Despite the activity in China’s economy beginning to pick up, its share market struggled to reflect the increased activity. The Australian share market was weighed down by the materials sector, falling 2.5% for the month, while in New Zealand some mixed company earnings results saw the share market drop 0.6%.

Europe was a bright spot for markets in February, with the share market seeing a gain of 1.7%. This was largely caused by markets in Europe having greater exposure to the financial sector, where higher interest rates can benefit banks and other financial firms. However, the European share market isn’t immune to the problems that other markets are currently facing, and still has issues it needs to work through in the short term.

Recent weather events will likely add to inflation pressures

The devastation caused by the recent cyclone in New Zealand is evident, with widespread damage to parts of the North Island. The economic cost of this damage is not yet known; however, it is clear that there will be ongoing disruption to businesses for some time.

The impacts of cyclone Gabrielle will be inflationary, meaning inflation will likely remain elevated for longer in New Zealand. Further pressure will be applied to supply chains after the damage to stock and infrastructure, while the cost to rebuild the impacted areas will likely put upward pressure on prices, driving the cost of goods and services up – especially in the construction, insurance, and food sectors.

The Reserve Bank of New Zealand recently had its first meeting of the year to discuss interest rates, choosing to raise them by 0.50%. The RBNZ had a difficult decision considering the recent events, however, monetary policy is relatively restricted in the help it can provide in an event like this. Because of this, the RBNZ chose to look through the short-term impact of the cyclone and focus on bringing inflation down, leaving fiscal policy (government spending), which is better suited at times like these, to help in the recovery.

Q4 Sustainability report

AMP is very committed to investing sustainably and supporting a better future for our planet, including working towards our net zero goal – zero net carbon emissions in our portfolio by 2050 or sooner. This is something we are working hard towards, and you can view our progress in our recently released Q4 sustainability report

Some of the highlights in this report are the decrease of our portfolio’s carbon emissions by 67% over the past 18 months, and increasing our Green Bond exposure, which are bonds that provide capital for specific projects with climate change mitigation and environmental outcomes. The total Green Bond exposure in our portfolio now equates to $65 million.

Market outlook

February has demonstrated that 2023 is not going to be a straightforward year for global markets. The latest inflation numbers indicate that inflation is remaining stubbornly high, while consumer spending and labour markets around the globe continue to remain resilient, all while unemployment rates are at record lows.

This points towards more market ups and downs as the battle for central banks to wrestle inflation under control continues. However, downturns in the market can provide an opportunity to buy assets at a lower price. This is the benefit of regularly contributing to your investments, an approach called dollar-cost-averaging.

It’s a good time to review your investments to make sure you’re in the right fund for your stage of life and risk tolerance. If you need some guidance with your investments, please reach out to your adviser or contact AMP for a little help.

Summary

Investors have had a positive start to the year, with global bond and share markets coming strongly out of the blocks. There is evidence to believe that price rises (as a result of inflation) may be slowing down, while the Chinese economy has been granted a boost as the borders re-open following the easing of its zero-Covid policy. The recent market developments point toward long-term optimism for markets and investors, however, before we get to that point, there is still lots to work through in 2023.

Encouraging start to the year

January provided investors with bouts of optimism to kick off the year, as investors hope to put the losses experienced in 2022 in the rear-view mirror. The typical market rally that is often experienced in December came a little late, with a market uplift in January leading to positive gains across bond and share markets worldwide.

In local currency terms, the US share market generated a monthly gain of 6.3%, while in Europe the share market gained 6.9%. Closer to home, the Australian share market was up 6.2%, while New Zealand lagged slightly, seeing a gain of 4.3% for January. The China share market was an outperformer for the month as it further eases its zero-Covid policy, up 8.3% for the month¹.

The strong performance of China has led to the Emerging Markets sector seeing a monthly gain of 5.6% in NZD terms, which has helped the returns for investors in our AMP diversified funds, where we have exposure to this asset class. Our allocation to NZ Inflation-linked bonds also added value for our diversified portfolios as the asset class performed strongly over the month, outperforming traditional Government bonds.

Inflation numbers providing optimism for investors

The January market rally was largely driven by the latest inflation numbers suggesting that the price rises of key goods and services across the globe may be starting to cool. Investors have been keeping a watchful eye on this data for the past twelve months in the hope that as inflation begins to slow, this should also slow the aggressive interest rate increases that central banks have been using to wrestle inflation under control.

The most recent monthly inflation number out of the US shows that in December, inflation sat at 6.5% on an annual basis, down from the 7.1% reading in the month prior and the 9.1% peak in June of 2022. While positive signs are beginning to show, it appears to be a different story in New Zealand as we continue to battle with the prices of food and other essential items.

The market has provided optimism, but over the long-term

Investor confidence has been given a boost recently following some positive market developments -one of which has been the reopening of China’s borders. After three years of closure, China has further relaxed its zero-Covid policy and will completely reopen its borders, dropping testing requirements and quotas. Not only has this move seen China’s share market perform strongly over the month, but the prospect of China returning to its production capacity prompts excitement that some global supply chain issues may begin to subside as production ramps up.

However, there are concerns that as China reprises its role as a low-cost producer, easing global supply bottlenecks, the revived demand for raw materials and energy that they require will push up the prices of those commodities. We know that energy prices have been a key input into inflation, so this is something that investors and central banks will remain wary of.

Market outlook

Although there is lots to be optimistic about in markets, this optimism should be put in the context of a long-term outlook, compared to what we might experience in 2023. There are still concerns in the market that will likely cause volatility in the short-term - economic recessions are anticipated in many countries, while the true effect of central bank interest rate increases are unlikely to have been fully felt. This points toward an ongoing uncertainty in markets over the next six months as Governments and central banks navigate the changing economic landscape.

What we do know is that market ups and downs are a normal part of investing. Focusing on your investment and savings time horizon through the short-term noise will help you achieve your long-term savings goals.

If you need a little help with your savings or investments, please contact your adviser or AMP.

¹ Returns are sourced from S&P Dow Jones Indices Index Investment Strategy Dashboard

2023 Global Outlook

Looking back over the year

2022 was a challenging time for share and bond markets around the world. Much of what we have experienced throughout last year can be split into three key themes:

1. Record high levels of inflation

2. Rising interest rates

3. Increased global political tensions.

These challenges were not a surprise and were broadly predicted by our investment partner BlackRock, within their Global Outlook for 2022, which was published late in 2021.

What to expect from the year ahead

At the end of last year, BlackRock released its 2023 Global Outlook, which is again centred around 3 key themes they believe will be evident in markets throughout this year. These themes are:

1. Pricing the damage - a consideration of a recession in 2023 and whether markets have priced in the impacts of a recession

2. Re-thinking bonds - where higher interest rates and increased yields provide an opportunity to consider how we capture value in bonds

3. Living with inflation - the situation where inflation is expected to settle at levels higher than the pre-pandemic era, and that there are structural changes in the economy that are here to stay.

What might this mean for investment markets in 2023?

We expect central banks to pause on their interest rate increases as inflation comes down from the levels seen in 2022. This should be supportive for shares and bonds relative to last year. However, central banks and governments, around the world and here in New Zealand, will continue to face the challenge of balancing growth in economies with inflation, meaning that we will continue to focus strongly on how we position our diversified portfolios through the structural changes that the world’s economies are navigating in this post-pandemic era.