Investment options with AMP Managed Funds

Do you want to get your money working for you? AMP Managed Funds are flexible investment options built to do exactly that.

We offer five Managed Funds investment options: Conservative, Balanced, Growth, Aggressive, and International Shares. Each is designed to grow your money differently, from slow and steady strategies to those with higher risk and reward.

No matter what stage of your investment journey you’re at, or what your financial goals might be, consider an AMP Managed Fund investment option to suit you.

AMP’s approach to managed funds (MFs)

Indexing

At AMP we believe that it is difficult to consistently outperform the market through short-term, active investment positions. This is why each of our MF investment options is designed to generate returns primarily through an index management strategy within asset classes. This helps to increase the likelihood of returns outweighing any losses.

Sustainability

We believe investing sustainably will deliver long-term returns equal to or better than the broader market index. We have a clear approach to sustainable investing based on four key pillars: support the good, avoid the bad, reduce our carbon footprint and advocate for change. Find out more about our Sustainable Investment Philosophy.

Cost-effectiveness

We believe that keeping costs down is an important component of generating an investment return, as charges will eat into your gains. All AMP Managed Funds investment options offer low fee structures (currently 0.79-0.80%*), helping you to hit your managed fund investment goals.

AMP Managed Fund types

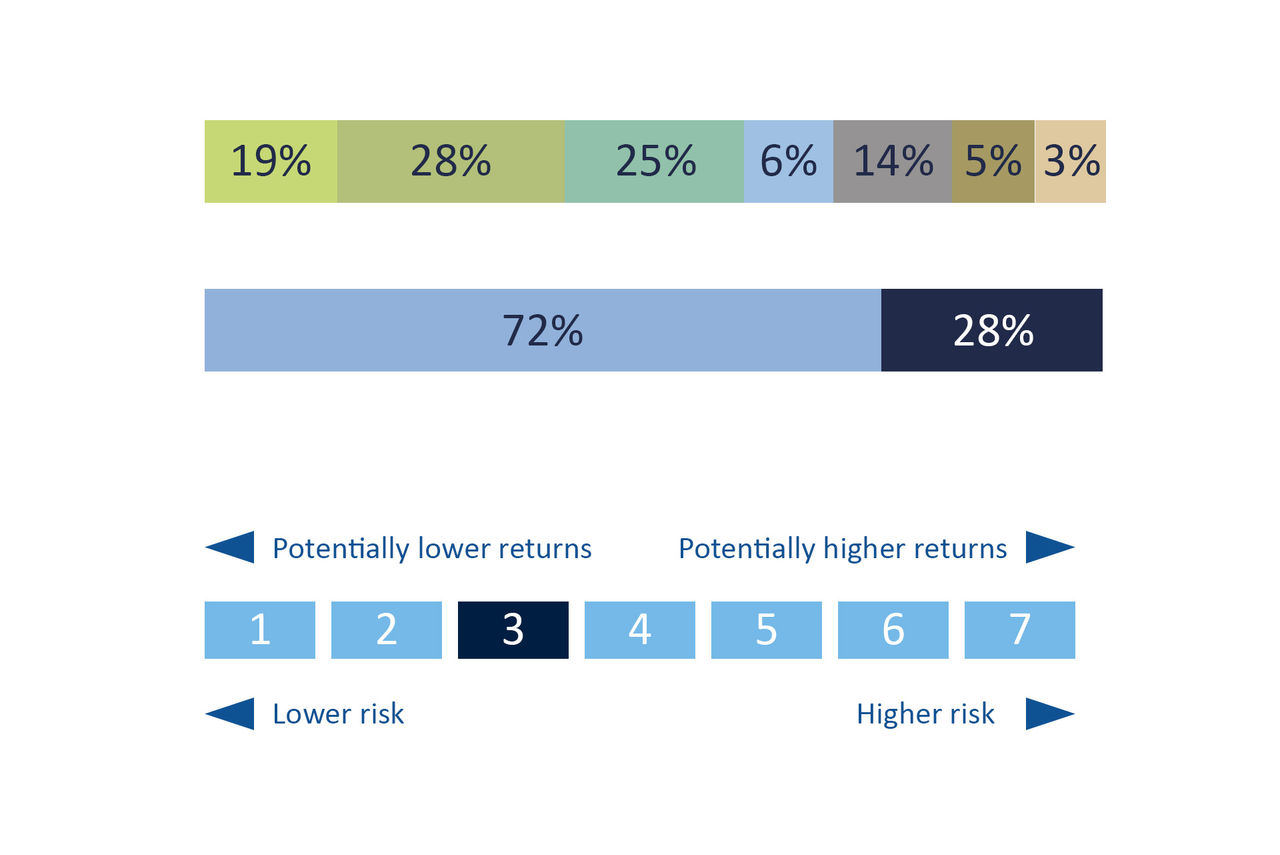

Conservative Managed Fund

Why should I choose this fund? AMP’s Conservative Managed Fund is designed for naturally cautious investors or investors who may want to withdraw in the short term.

This fund is designed to drive modest to medium returns with less volatility, particularly in the short-term. This fund aims to provide a diversified portfolio that primarily invests in lower-risk income assets, with a small allocation of higher-risk growth assets.

Minimum suggested investment timeframe: 2 years

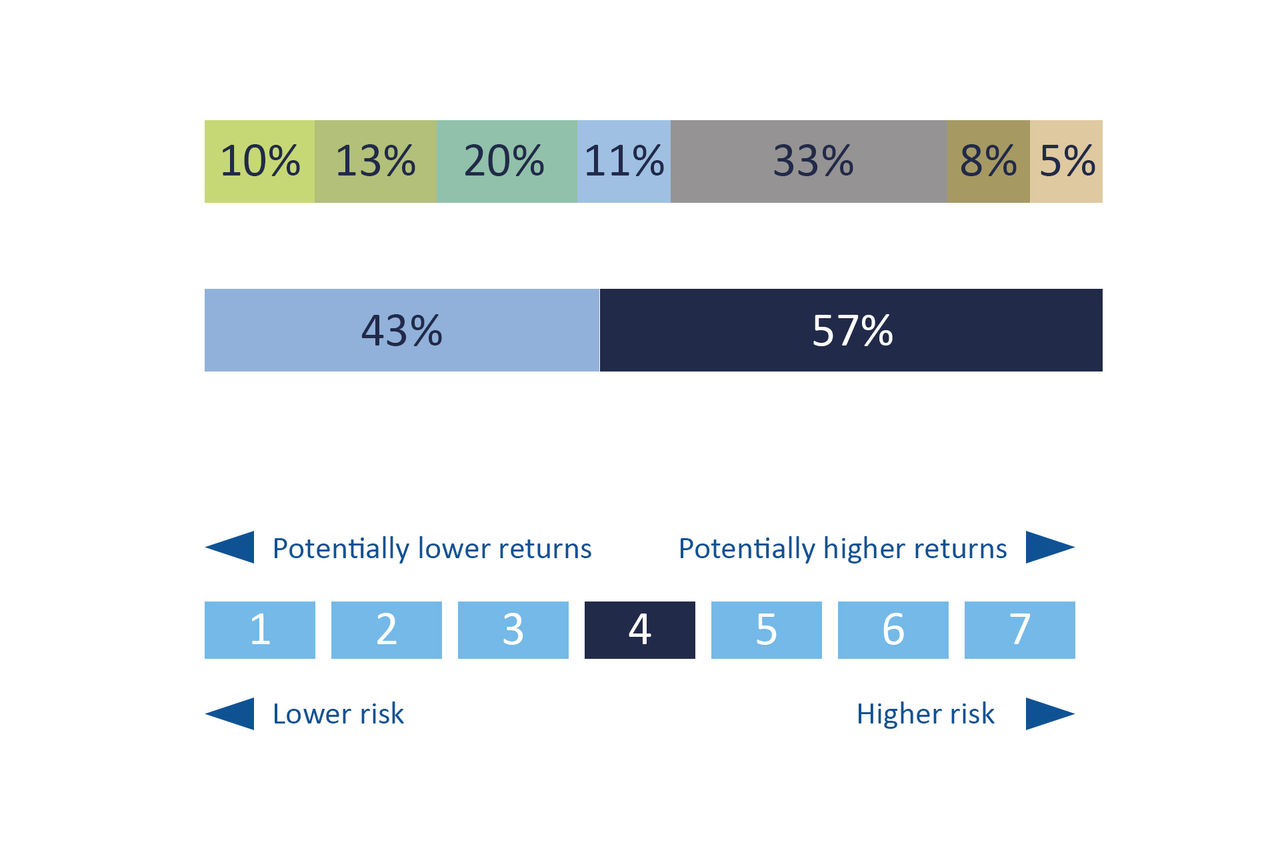

Balanced Managed Fund

Why should I choose this fund? AMP’s Balanced Managed Fund is designed for longer-term investors who are looking to balance risk and reward.

This fund is designed to drive medium returns resulting in some movements up and down in the value of your investments. It aims to provide a well-diversified portfolio that features similar levels of higher-risk growth assets and lower-risk income assets, granting investors greater scope for returns than our Conservative Managed Fund.

Minimum suggested investment timeframe: 4 years

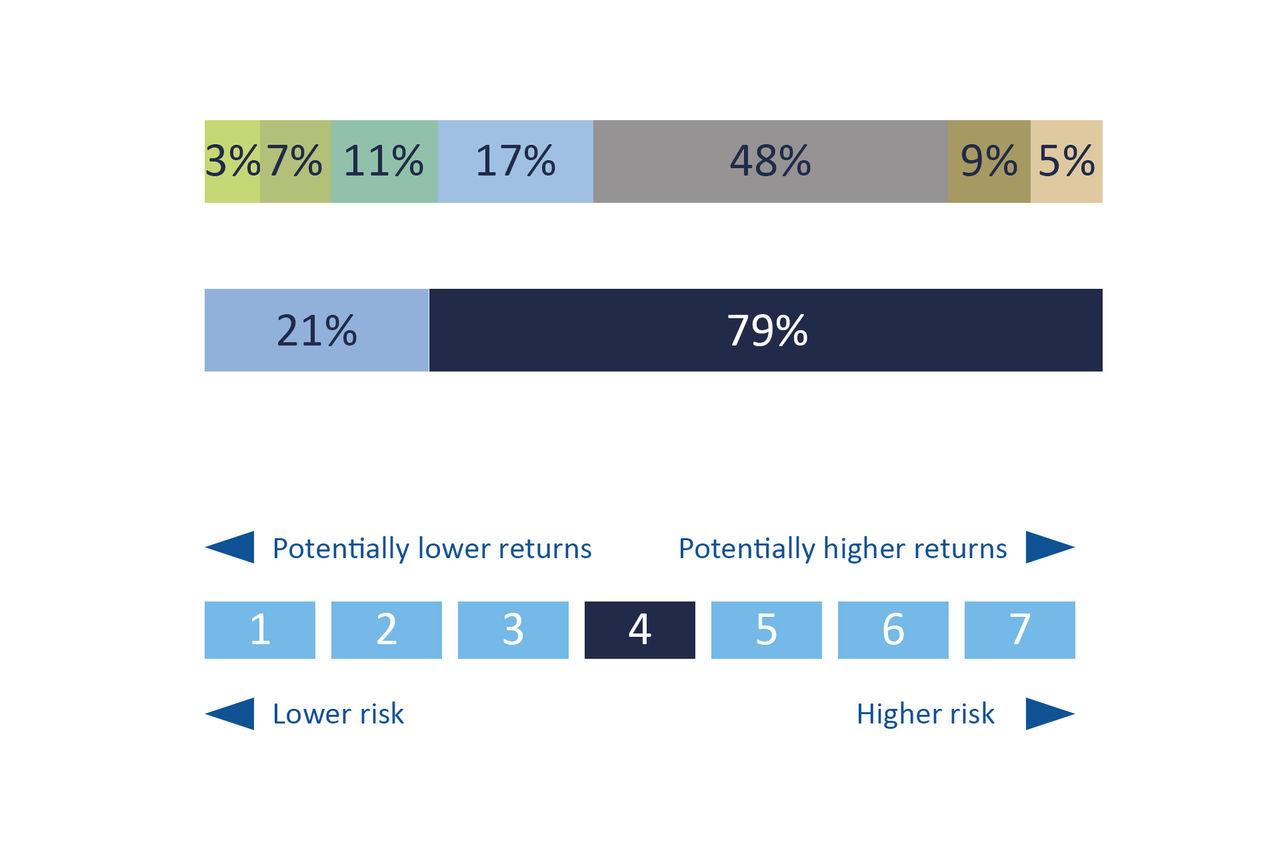

Growth Managed Fund

Why should I choose this fund? AMP’s Growth Managed Fund is designed for longer-term investors looking to maximise potential returns, and who are comfortable with greater risk.

If you’re looking for the greatest opportunity to grow your investment over the long-term, and if you’re comfortable with the increased volatility that comes with a higher-risk, higher-reward strategy, our Growth Fund may be the ideal option. This fund is predominantly made up of growth assets, and it rewards long-term investors as volatility is mitigated over time.

Minimum suggested investment timeframe: 7 years.

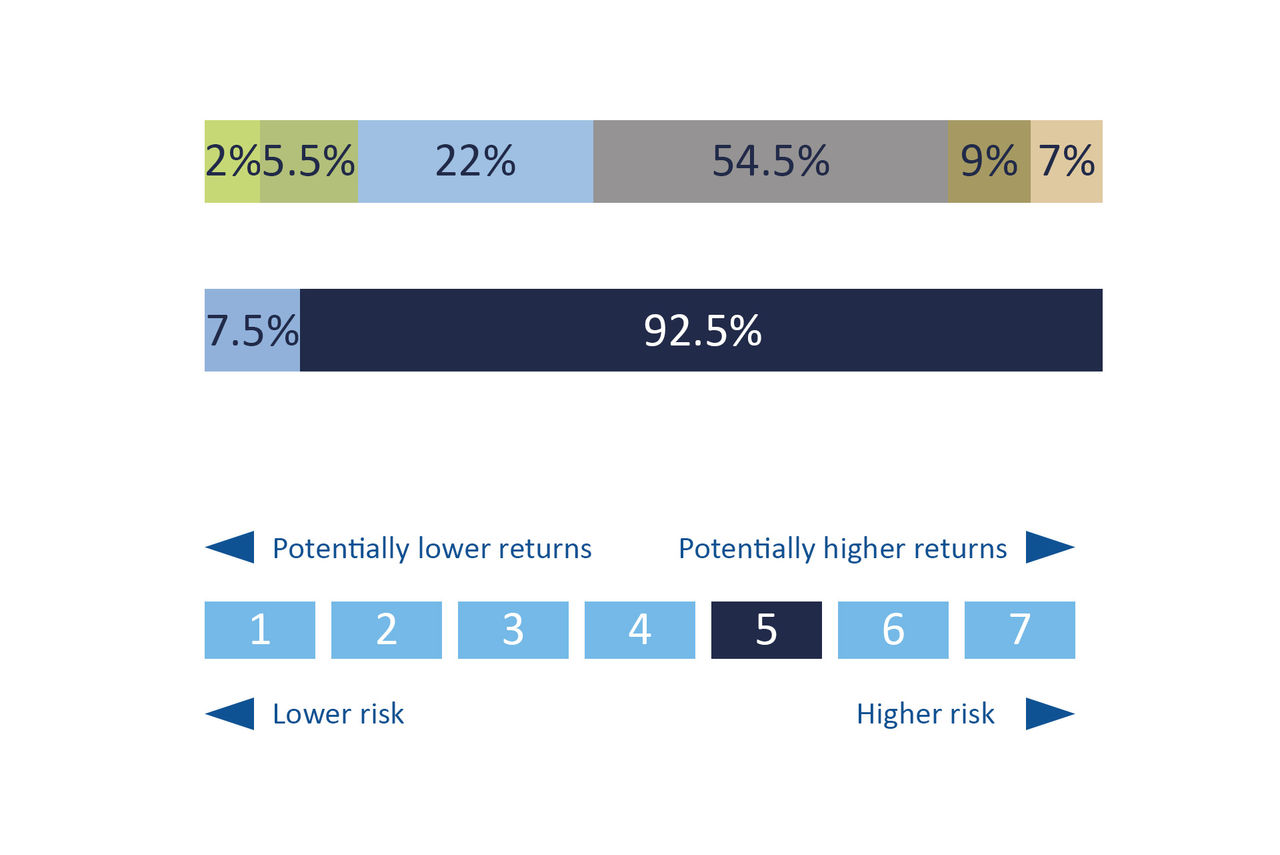

Aggressive Managed Fund

Why should I choose this fund? AMP’s Aggressive Managed Fund is designed for investors who are comfortable taking on higher risk for potentially higher returns over the longer-term.

The goal of this fund is to drive high returns over the long-term and comes with greater volatility (larger movements up and down in the value of your investment). If you’re looking for the greatest opportunity to grow your investment over the long-term, and if you’re comfortable with the increased volatility that comes with a higher-risk, higher-reward strategy, our Aggressive Fund may be the ideal option. This fund is predominantly made up of growth assets, and it rewards long-term investors as volatility is mitigated over time.

Minimum suggested investment timeframe: 10 years.

International Shares Managed Fund

Why should I choose this fund? AMP’s International Shares Managed Fund is designed to provide investors with exposure to international equities. This is a single sector fund and as such can potentially lead to larger movements up and down in the value of your investments (due to the concentration in a particular asset class).

If you’re looking for an opportunity to grow your investment through exposure to international markets, our International Shares Fund may be a good option.

Minimum suggested investment timeframe: 10 years.

The AMP Managed Funds investment mix information above is correct as of 21 October 2024.

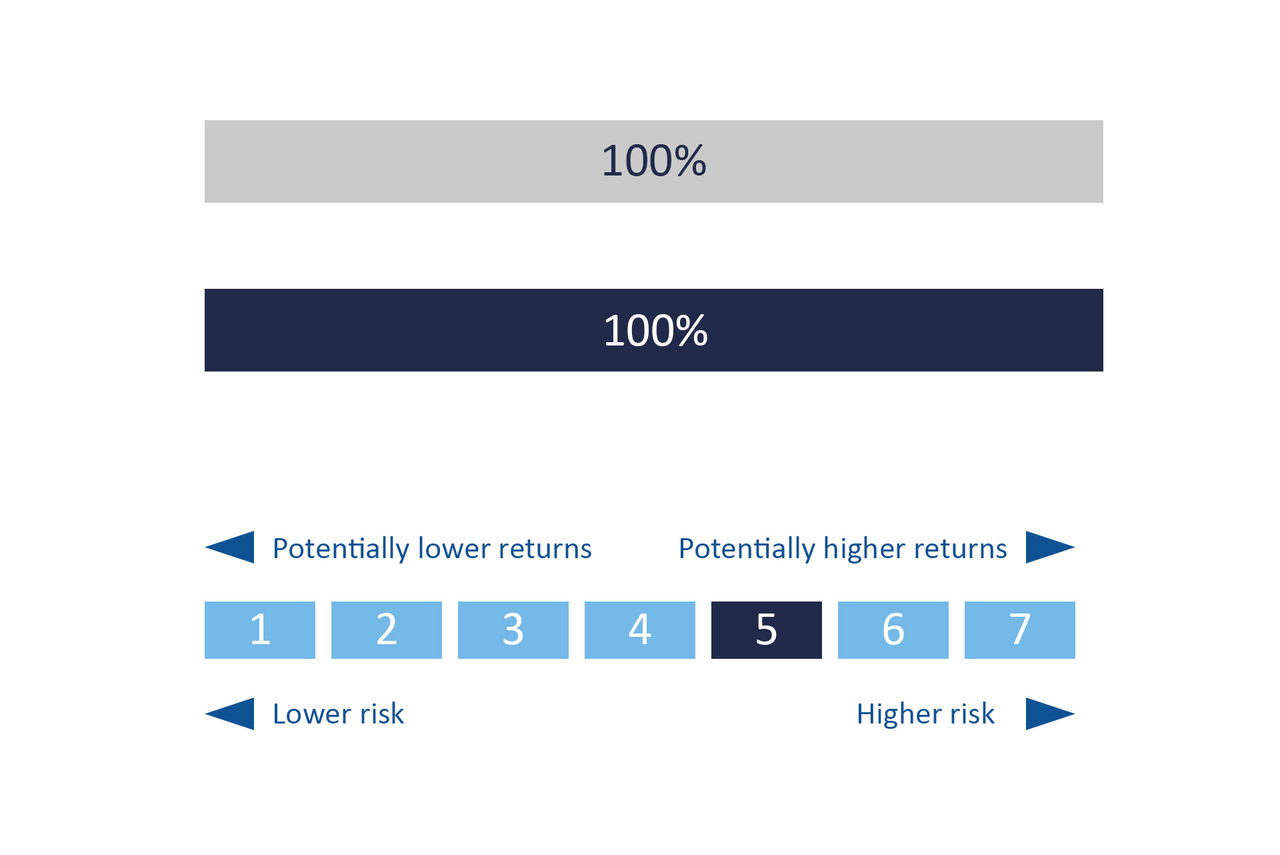

Target investment mix legend

This legend has been used to show the types of investments included in each of our Managed Funds investment options. It allows you to gain a deeper understanding of how the investment composition of each fund affects its risk-return profile.**

*Current AMP Managed Funds fee charges as at October 2024.

**We have used market index returns to calculate the risk indicator for each fund. As the funds do not yet have a full five years of returns data from which to draw. Market index returns were used for the five years to 31 March 2022. This means that the risk indicators for the funds do not reflect the actual returns for this period. Therefore, these risk indicators may provide a less reliable indicator of the potential future performance and volatility of these funds.