How we invest

Sustainable growth and stability for our members

AMP exists to help Kiwis achieve a better financial future

We’ve been doing this since 1854 - so we understand, better than anyone, that good things take time. We take a long-term approach to investing - prioritising sustainable growth and stability for our members. We provide simple, accessible & sustainable index tracking managed funds. Our funds aim for market returns, while keeping investment costs down – meaning higher-than-average returns for our members.

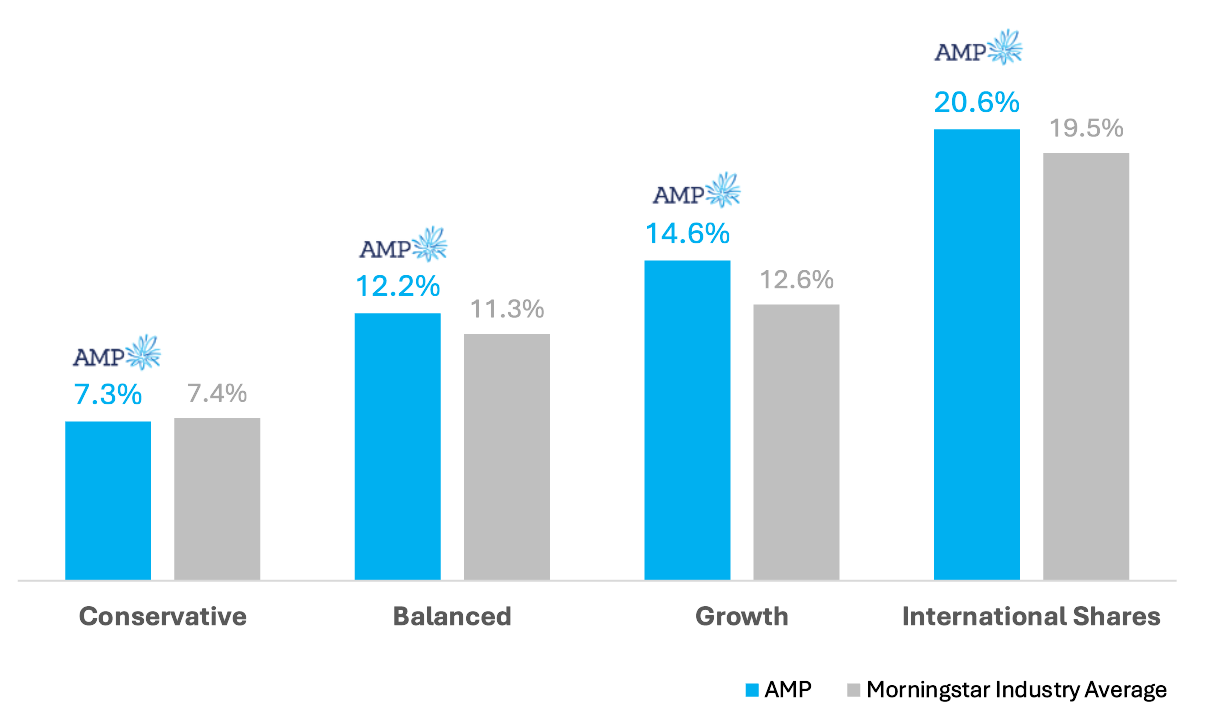

How AMP funds compare to the industry average

3-year returns as of October 2025. This graph shows how our KiwiSaver funds have performed against the industry average since we changed our investment approach. How investments have performed in the past doesn’t always show how they’ll do in the future. Returns can go up or down, and nothing is guaranteed.

Choice is important

Investing isn’t one size fits all. That's why we offer a variety of investment options from leading investment and fund managers. This gives you more options to pick from, depending on what works best for you.