Fees methodology

Let’s talk about fees

Recently you would have received your AMP KiwiSaver Scheme Annual Statement – this statement shows what you currently have in your account and what you could have when you retire.

To help you understand your fees, your statement also shows you the fees we charge as both a dollar and percentage amount. Below you can see how we used one of the Financial Markets Authority (FMA) recommended methodologies to work out your fees and how we use those fees to provide you with a little help.

Remember fees are just one small part of KiwiSaver. If you want to see how our fees stack up against the rest, check out the Sorted Fund finder or FMA KiwiSaver Tracker to compare funds and fees.

We’re here to be your guide.

Here are some of the ways we use your fees to help you get the best from your AMP KiwiSaver Scheme:

- Need help choosing a fund or planning your savings? Just talk to your Adviser or call one of our KiwiSaver experts and we can help.

- Getting updates when you want them: Want to check your progress? You can view your AMP KiwiSaver Scheme account balance 24/7 with the My AMP app.

For help on understanding your fees or your KiwiSaver account, please talk to your Adviser or call us on 0800 267 5494.

A disclosure statement is available from your Adviser, on request and free of charge.

Fees Methodology for fees disclosed in the AMP KiwiSaver Scheme Annual Statement

The AMP KiwiSaver Scheme Annual Statement shows the total fees we charged you for the relevant accounting period. This is shown as a dollar amount and as a percentage of your average daily balance.

This page explains what methodology we have used to calculate the following fees:

- total fees as a dollar amount

- fees, costs and expenses of the underlying funds

- total fees as a percentage

1. Calculation of total fees as a dollar amount

The approximate total sum of fees (shown under ‘Total fees paid’ in the AMP KiwiSaver Scheme Annual Statement) is the approximate sum of all fees incurred in the accounting period 1 April to 31 March, or if you joined part way through a year, from your joining date. This includes

- total fund charges,

- individual action fees and other charges (member fees).

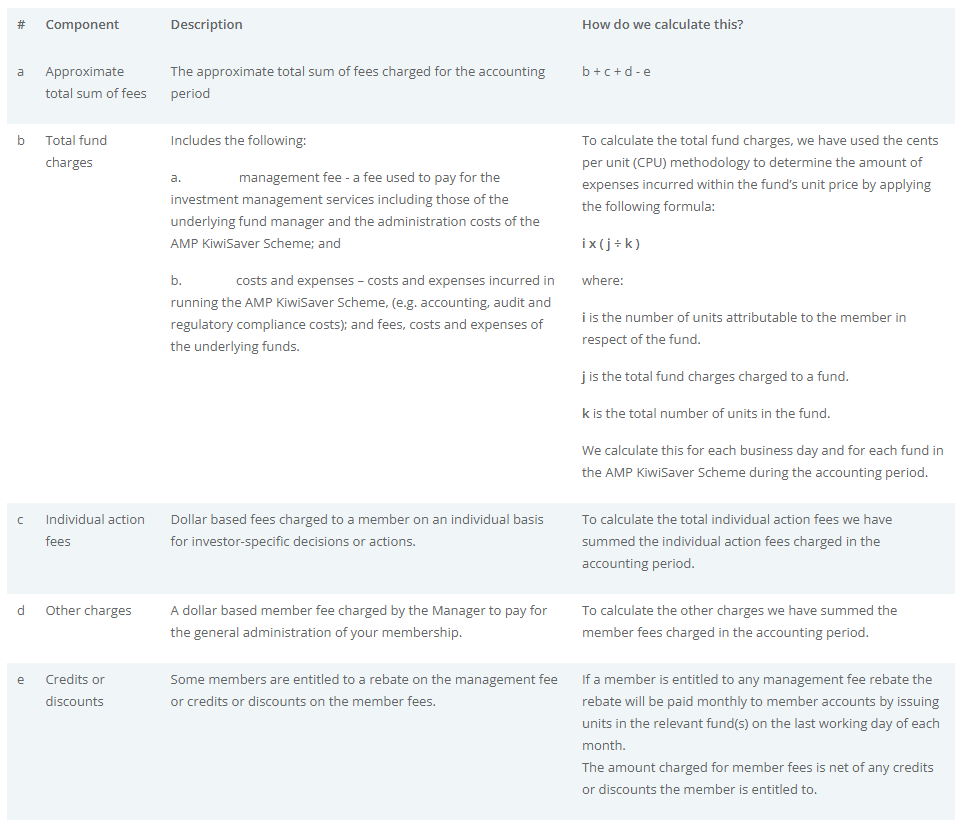

The approximate total sum of fees charged for an accounting period is calculated using the following formula:

a = b + c + d - e

where:

For example, Tracey invests $10,000 in the AMP Balanced fund. She is not invested in any other fund in the AMP KiwiSaver Scheme. The total fund charges are $77.00 and she paid $23.40 in member fees. Tracey didn’t have any individual action fees in the accounting period. Therefore, her total approximate sum of fees is $100.40.

Approximate total sum of fees ($100.40)

= total fund charges ($77.00)

+ individual action fees ($0) + other charges (member fees) ($23.40)

- discount ($0)

Calculation of the fees, costs and expenses of the underlying funds in which the AMP KiwiSaver Scheme invests

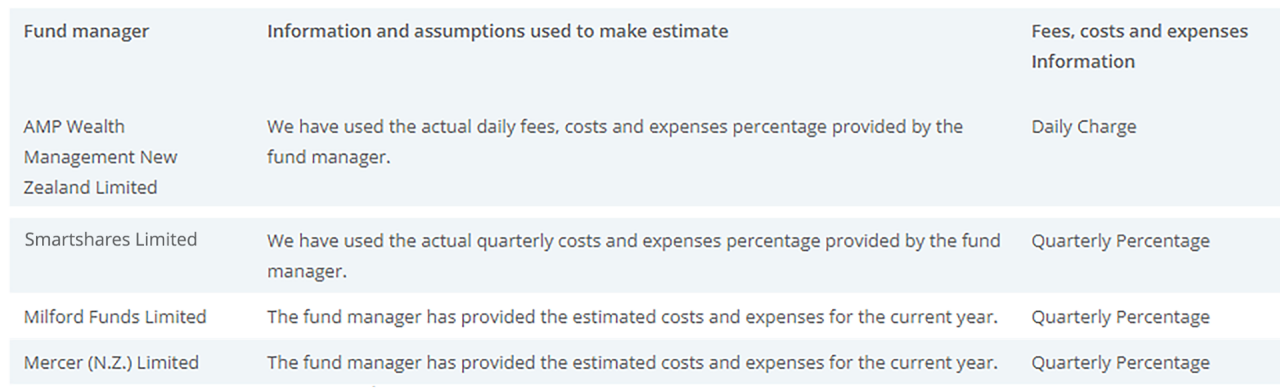

To calculate the underlying fees costs and expenses (which are included in the fund charges portion of the approximate total sum of fees), we have used fees, costs and expenses information provided by the underlying fund managers, where the fund manager is not AMP Wealth Management New Zealand Limited (Quarterly Percentage). We used the Quarterly Percentage to estimate the daily charge and applied this consistently across the period. This charge has then been allocated based on a member’s daily holding in the fund for each day during the period.

Where AMP Wealth Management New Zealand Limited is the underlying fund manager a daily charge is provided as a cents per unit value.

In calculating the Quarterly Percentage, we have used the actual or estimated fees, costs and expenses percentages provided by the underlying fund managers.

Accordingly, in preparing the Quarterly Percentage, we have assumed:

- that the relevant fund manager has calculated the fees, costs and expenses percentages provided in accordance with the Financial Markets Conduct Act 2013 and Financial Markets Conduct Regulations 2014;

- that, where a fund manager has provided estimated fees, costs and expenses percentages, those estimates are reasonable estimates of the actual percentages charged over the relevant period; and

- that, where the percentages provided by a fund manager are not based on the actual period (such as historic periods), the alternative period is the most recent for which the information is available.

The table below outlines the methodology used, together with any additional estimates and assumptions made, in respect of calculating the fees, costs and expenses of each fund manager.

Calculation of total fees as a percentage amount

Two types of fees are shown in the Annual Statement as a percentage of the member’s average daily balance: (1) total fund charges and (2) member fee.

Total Fund Charges:

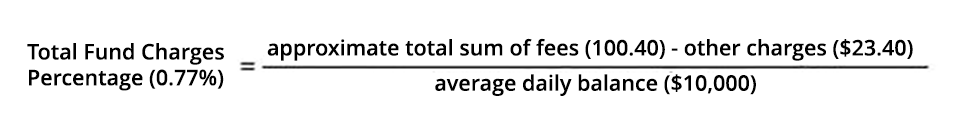

Total fund charges as a percentage of the member’s average daily balance is calculated using the following formula:

where:

a = the total fund charges percentage

b = the approximate total sum of fees (see above)

c = other charges

d = average daily balance (the sum of the member’s daily balances (for all priced days) divided by number of priced days).

For example, Tracey invests $10,000 in the AMP Balanced Fund. Her total approximate sum of fees is $100.40 (see above example). Tracey’s average daily balance is $10,000.

Therefore, her total fund charges percentage is 0.77% of her average daily balance:

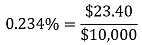

Member fee:

Member fee as a percentage of the member’s average daily balance is calculated using the following formula:

Member fee percentage = other charges in dollars ($) / average daily balance

For example, Tracey invests $10,000 in the AMP Balanced fund. Tracey pays other charges (member fee) of $23.40 per year. Tracey’s average daily balance is $10,000. Therefore, her member fee percentage is 0.234% of her average daily balance.

If you have any questions, please contact our customer service team on 0800 267 5494 or email us at kiwisaver@amp.co.nz.

AMP Wealth Management New Zealand Limited is the issuer of the AMP KiwiSaver Scheme. Please click here for a copy of the AMP KiwiSaver Scheme Product Disclosure Statements.