AMP Moderate Balanced Fund ranked #1

The MJW Investment Survey places the AMP Moderate Balanced Fund at #1 over 1, 3 and 10 years - reflecting a steady, disciplined approach.

What independent data says about AMP’s long‑term performance

For most New Zealanders, KiwiSaver is one of the largest and most important long-term investments they’ll ever make. Yet unlike a house or a business, it’s not something most of us want to check on every day. What we do want is confidence: confidence that our savings are being carefully managed, that fees are fair, and that our provider has a disciplined approach that works over the long run - not just in the headlines of the moment.

That’s why independent assessments like the MJW Investment Survey play such a crucial role. They give New Zealanders a clear, unbiased picture of how their KiwiSaver provider is really performing. And the latest results tell a compelling story for AMP members.

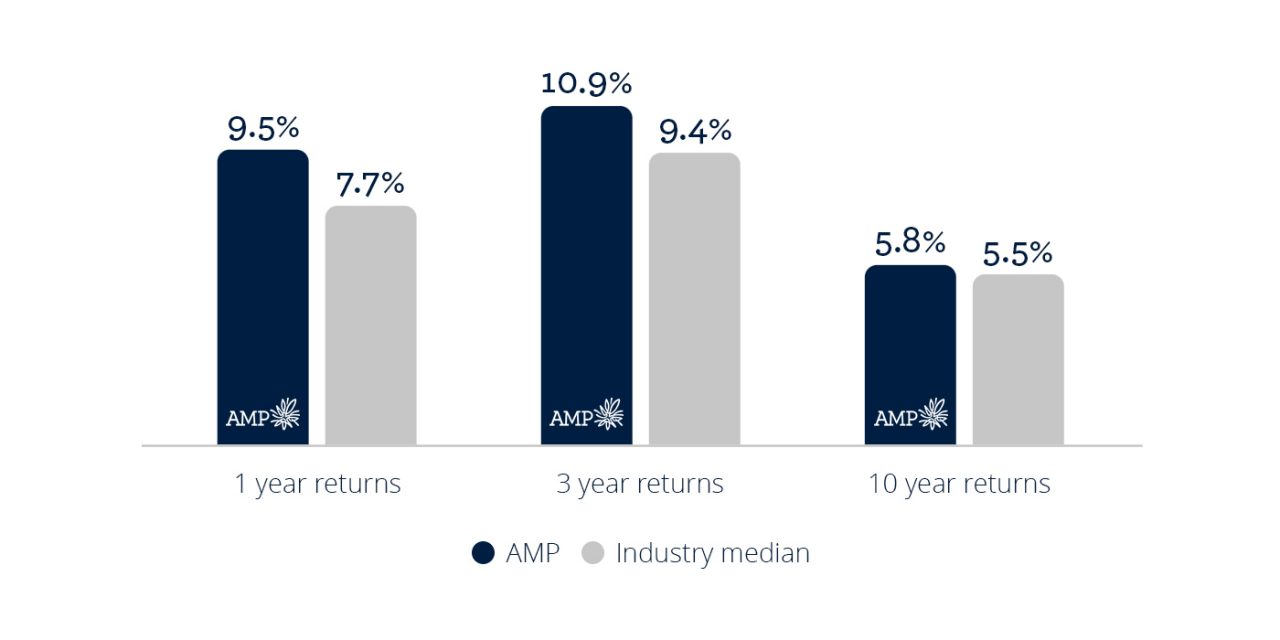

According to MJW’s December 2025 Investment Survey (‘MJW Survey’), the AMP Moderate Balanced Fund has ranked #1 for returns over 1, 3 and 10 years in the Moderate category. For members, this is a meaningful validation - not a momentary spike, but independent data confirming the strength of AMP’s investment approach across a full decade of the ups and downs of different market conditions.

AMP Moderate Balanced Fund vs industry median

Performance references are based on the MJW December quarter KiwiSaver Investment Survey (Dec 2025). See: MJW Investment Survey.

Strong, steady performance that supports your financial goals

KiwiSaver is a long game. The last three years have been a reminder of how unpredictable markets can be - from global inflation and shifting interest rates to geopolitical challenges and rapid technological change. Through all of this, KiwiSaver providers have had to navigate complexity while staying focused on growing members’ savings.

The MJW Survey shows that the past three years have been particularly strong for KiwiSaver members industrywide, and that AMP stands out for consistent, top-tier performance. AMP’s Moderate Balanced Fund’s #1 ranking across 1, 3 and 10 years demonstrates exactly what long-term investors are seeking: stability, resilience and results that hold up not just during good periods, but across the highs and lows of a typical economic cycle.

Crucially, these results reflect more than just favourable market conditions. The deliberate investment reset that AMP undertook four years ago was a major driver of the strong performance results we are now seeing. At that time, we redesigned the way we invest to deliver:

- Stronger long-term returns

- Lower fees

- More sustainable investment choices

Those changes are now delivering real, measurable value for members - and the MJW Survey results, particularly in the moderate balanced category, confirms that AMP’s long-term strategy is not just working, but outperforming.

An approach designed to keep your savings moving forward

KiwiSaver isn’t a short-term project. Most members will be invested for 30 to 40 years. Over that period, markets will rise, fall and fluctuate - sometimes sharply. New providers will emerge, and economic conditions will shift. In the end, strong outcomes are largely driven not by short bursts of performance, but from consistent, disciplined decisions. AMP’s investment approach is built on exactly that philosophy.

Our goal is not to chase the hottest trend or react to every news cycle. Instead, we manage members’ savings in a way that aims to deliver strong returns while also managing risk in a world that can change quickly. The AMP Moderate Balanced Fund’s consistent performance across short, medium and long time periods demonstrates the resilience of this approach. It’s not reactive. It’s not speculative. It’s long-term investing delivering long-term results.

And the story extends beyond just one fund. Across AMP’s Growth, Balanced and Conservative options, performance has been consistently strong over multiple timeframes. This solid track record reinforces AMP’s commitment to delivering dependable long-term outcomes.

What Kiwis need to feel confident about their investment decisions

It’s one thing for a provider to say they’re performing well; it’s another for independent results to confirm it. For members - and for Kiwis considering switching providers - independent verification of performance provides:

1. Confidence to stay invested

Markets can be noisy. Media headlines can be unsettling. But when independent analysis shows a fund leading its category consistently over 1, 3 and 10 years, it reinforces the value of sticking to a plan rather than reacting emotionally to short-term volatility.

2. Assurance that fees and value are aligned

Four years ago, AMP lowered fees as part of its investment reset. These results show that lower fees didn’t come at the expense of performance.

3. Trust in a provider that evolves with you

Members’ needs change over time. Whether you’re early in your career, approaching retirement or already drawing down funds, guidance matters. The support that AMP is set up to provide is designed to help members adjust their fund choice, contribution rate and investment settings as their lives and goals evolve.

In a market full of noise, consistency wins.

It’s easy to be tempted to switch providers or funds when markets fluctuate. However, AMP’s consistent performance, as reflected in the MJW Survey results, reinforces a key principle of long-term investing: discipline and consistency tend to outperform reactive decision-making. Switching based on short-term performance can mean locking in losses or missing the rebound that often comes after market dips. AMP’s performance demonstrates that a stable, disciplined strategy - one that doesn’t chase quick gains - can deliver stronger results over time.

With top-tier performance across such a wide range of time periods, AMP offers both new and existing members something increasingly valuable: confidence built on evidence.

Next steps

Whether you’re just joining KiwiSaver, growing your nest egg, or looking to withdraw your funds at the perfect time, we’re always on hand to guide you on your KiwiSaver journey. We also give you total control over your money via the MyAMP app and online portal.

Past performance is not a reliable indicator of future performance. Returns over different periods may differ. The minimum suggested investment timeframe for the AMP KiwiSaver Scheme Aggressive, Growth, Balanced and Moderate Balanced funds is more than 1 year.

Performance references are based on the MJW December quarter KiwiSaver Investment Survey (Dec 2025). See: MJW Investment Survey.