Lifesteps

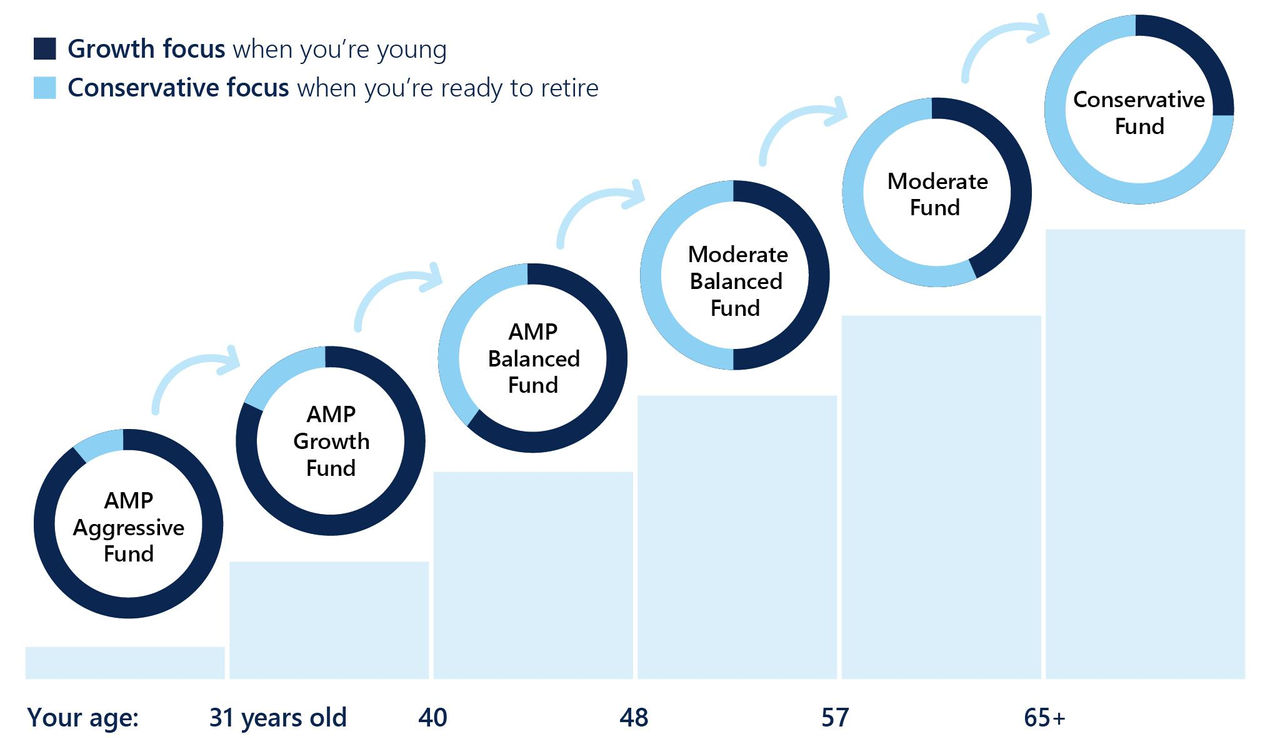

An investment plan that automatically reduces the level of growth assets as you age.

Lifesteps makes it easy

The easiest way to make sure your AMP KiwiSaver Scheme funds are appropriate for your age and stage in life is to choose Lifesteps, an investment plan that automatically updates your fund as life moves on.

When you are younger, you can accept more volatility (up and down fluctuations) in investment returns in exchange for the potential to earn higher returns. As you get older, you have less time to recover any losses before needing your retirement savings. Lifesteps aims to reduce the potential for investment losses as you age.

How Lifesteps works for you:

Ben

Ben knows nothing about investments. Risks, returns, funds…it’s all a foreign language to him.

He also has a very busy life, juggling work and family commitments.

That’s why he decided to go with Lifesteps, the investment plan that automatically adjusts itself as he gets older.

Sarah

Although retirement is only about 12 years away, 50-something Sarah has just joined KiwiSaver. She studied the benefits and decided that it was not too late to start accumulating a decent lump for her retirement.

Sarah chose to invest in the AMP Lifesteps Programme, because she won’t have to think about switching funds as she gets older. Lifesteps has put her money in the AMP Moderate Balanced Fund, which aims to earn medium returns.

There might be some movements up and down in the value of her investments, but Sarah knows this is normal for a moderate fund.

Olivia

Aged 34, Olivia is currently on maternity leave. She plans to return to work in about a year, depending on how she and her husband manage on a single income.

She’s been a KiwiSaver member since the scheme started in 2007 and chose AMP as her provider. When the Lifesteps programme was offered to her, Olivia recognised that it’s an easy way to ensure savings are in step with different stages of her life.

Currently Lifesteps has her money invested in the AMP Growth Fund, in pursuit of greater long-term returns. To keep her KiwiSaver balance growing while she’s being an at-home mum, Olivia has set up a direct debit of $25 a week. Contributing at least $21 a week will also make sure she gets the full Government contribution of $260.72

Please note Lifesteps does not take personal circumstances into account, such as saving for a first home, so may not be right for everyone.

Want a little help?

Help me to...