How much money do I need to retire in NZ?

“How much do I need to retire?” It’s a question many Kiwis ask when they start planning for life after work.

The truth is, there is no single “magic number” that works for everyone. How much you’ll need depends on several factors like how much you plan to spend in retirement, how long you expect to be retired, and what support you’ll receive from the government (e.g. New Zealand Superannuation).

Your desired lifestyle plays a big role too. For some, retirement means a quiet life by the beach. For others, it’s traveling the world. That’s why the amount you’ll need is unique to you.

In this guide, we’ll walk you through how to estimate what you might need, so you can plan ahead for the retirement lifestyle you’ve always imagined.

How much will I spend in retirement?

A good starting point for retirement planning is to estimate how much you’re likely to spend. This means thinking about your living costs and any extras you’d like to enjoy.

To help with this, Massey University publishes the New Zealand Retirement Expenditure Guidelines each year. In this section, we’ll explore how these guidelines can help you estimate how much you’ll spend.

What kind of lifestyle will you live?

Massey University’s guidelines break down retirement spending into two key categories:

No frills budget (basic): This reflects a basic lifestyle with little room for extras or unexpected costs.

Choices budget (comfortable): This reflects a more comfortable lifestyle and allows for more flexibility and extras, like dining out, hobbies, and travel.

Deciding on the lifestyle you want in retirement helps you understand whether it aligns with a basic or comfortable standard and what level of savings you’ll need.

Where will you live?

The cost of retirement in New Zealand also varies depending on your location. It’s no secret that living in a major metropolitan (metro) center like Auckland or Wellington generally comes with higher costs. In contrast, living in a regional town (provincial) may mean your day-to-day expenses are lower.

When planning, it’s useful to consider where you see yourself living. Do you plan to stay in your current home? Or are you thinking about downsizing or moving to a different part of the country to be closer to family? Your answer will have an impact on how much you may spend in retirement.

What will your spending look like in retirement?

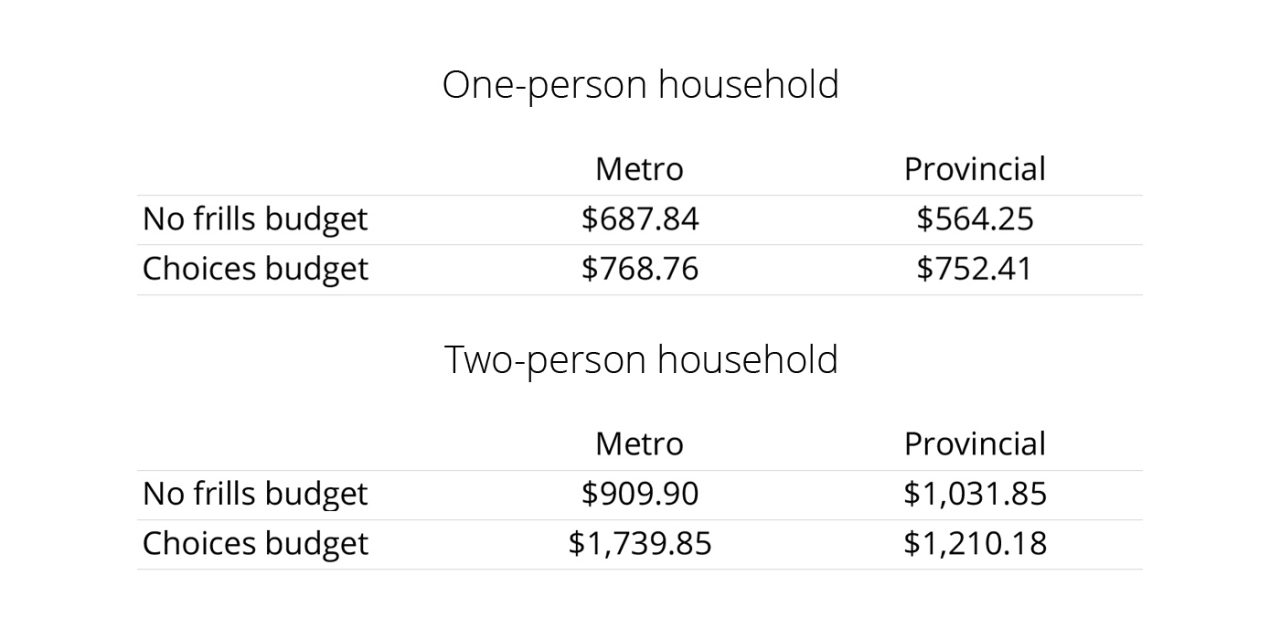

Now you’ve thought about your retirement lifestyle and where you’ll live, you can use the table below (developed by Massey University) to estimate weekly expenditure. Keep in mind these figures assume you’re mortgage-free. If you’re still paying off a mortgage, other debt, or rent, your retirement spendings may be higher.

Total weekly expenditure guidelines

According to the guidelines, a single retiree living in a metropolitan area, in their own mortgage-free home, and following a no frills lifestyle will need about $688 a week. A no frills budget covers only the essentials such as food, housing costs, utilities, transport, and healthcare, without extras like entertainment, travel, or new clothes.

Though, most Kiwis will want some level of comfort in retirement. In that case, a weekly budget of around $769 might be more suitable. This amount allows for occasional luxuries such as new clothes, travel, treating the grandkids, or going out for a meal.

What does your spending look like pre-retirement?

While the Massey Guidelines offer a helpful baseline for understanding retirement spending in New Zealand, at AMP we often find that many customers need more than what these benchmarks indicate.

One helpful way to get a clearer picture of what you might spend in retirement, is to look at your pre-retirement spending. Understanding what it costs to maintain your current lifestyle can provide an indication of what you may need later on – adjusted for the expenses that may reduce over time, such as mortgage, commuting costs, or the impact of downsizing.

Because everyone’s lifestyle and financial situation is different, this approach may help you create a more realistic plan tailored to your needs.

How long will I be retired?

Once you know your estimated weekly spending, the next step is figuring out how many years you’ll need to budget for. In other words, how long you’re likely to live. It might feel a little dark, and there’s obviously no way to predict an exact number, but having a rough idea is important for planning your retirement savings.

In New Zealand the average life expectancy for both women and men is a little over 80. But it is always rising, and if you make it to 65 the number is even higher: based on current figures, a woman who reaches the age of 65 in 2026 can then expect to live to around 88 years of age.

A wealth of other factors play their part, such as lifestyle, genetics and luck. If your parents and grandparents lived to a ripe old age, and you keep fit and don’t smoke, you are likely to live longer than average. The Stats NZ calculator considers a number of relevant factors, along with historical data, to give you a lifespan estimate.

What support will I receive from the government?

New Zealand Superannuation (NZ Super) is a government-funded, fortnightly pension available to eligible New Zealanders aged 65 and over. It’s an important factor to consider when planning for retirement, but NZ Super only goes so far. For many people, there can be a gap between what NZ Super provides and the lifestyle they’d like to enjoy. Even so, it can still play a useful role in supporting and supplementing your personal retirement savings.

How much NZ Super do I get if I’m eligible?

The payment is not means tested, but it does change depending on your tax code and whether or not you have a partner.

Here are the current NZ Super/pension rates from 1 April 2025 using tax code 'M' (the standard tax code if NZ Super is your primary income). For other tax codes, see the Work and Income website.

How much do I need to save for retirement?

So, the big question: how much do I need?

A great place to start is with our KiwiSaver Retirement calculator. It looks at your current KiwiSaver savings, makes a projection on what those savings will be at retirement, then compares your projected annual retirement income against what you’ll need to live your desired lifestyle in retirement: basic, comfortable or somewhere in between.

Once you have your baseline, you can tweak variables such as retirement age, lifespan, KiwiSaver contribution rate, KiwiSaver fund choice and the inclusion of NZ Super to understand how you might reach your goal.

Planning for retirement can feel like a lot to wrap your head around, but once you have a clearer idea of how much you might need — and for how long — it can be much easier to shape a savings plan that works for you. Your retirement is personal, and with the right tools and preparation, you can head into the future feeling more confident and in control.

Saving for retirement? We’re here to help

Whether you have just begun your KiwiSaver journey or you’re about to retire, it’s never too late to create a savings plan for your post-work future, and our AMP retirement experts are always ready to offer support and advice. Get in touch today:

We recommend speaking to a financial advisor when looking for financial advice. By speaking with a financial advisor, you can find out how your plan is working (or not) for you, and they can provide guidance on some suggested changes if needed.

As an AMP KiwiSaver Scheme customer, you have access to bespoke financial advice, based on your financial situation, whenever you need it, which can be obtained either through AMP or an external adviser. The financial planning advice that can be provided by an internal AMP adviser is limited to AMP products, whereas an external adviser may be able to advise you on a broader range of financial matters.

Find the right KiwiSaver funds

At AMP we offer dozens of different investment funds, across the spectrum of risk vs reward, from six of New Zealand’s leading fund managers. You can choose up to seven, and your ideal mix will depend on your retirement savings goals and the stage of your KiwiSaver journey you’re currently at.

Choose your funds

Maximise your savings

The more money you contribute to your KiwiSaver, the more money you’ll have to enjoy when you retire. KiwiSaver contributions come in several forms: employee contributions, compulsory employer contributions, government contributions and voluntary contributions (regular or lump sum). Learn more here.

KiwiSaver contributions

AMP Managed Funds

KiwiSaver is just one of the investment strategy options available for your retirement savings. If you’re interested in exploring other ways to grow your retirement nest egg, AMP Managed Funds can prove great sources of income, and have the added bonus of no lock-in period, so you can access your money whenever you choose.

Learn more

Explanatory notes:

- These guidelines do not represent recommended levels of expenditure.

- The levels of expenditure shown in the guidelines may be used to assist in the development of projected retirement budgets, by providing information about actual levels of expenditure in retired households in standard expenditure categories.

- The guidelines are based on averages for quintiles.

- There are too few responses for spending in some expenditure sub-classes to permit reliable estimation; however, these responses can be included in the class estimation where there are more responses. As a result, the classes are not always the totals of the sub-classes.

- The Household Economic Survey, on which the guidelines are based, relies on participants to accurately record their expenditure, and is only for a two-week period, which may not represent a typical fortnight for that household.

- The guidelines should not be used as a substitute for professional advice specific to individual circumstances.

- There is no retirement age in New Zealand, but the age of eligibility for NZ Superannuation (currently 65) is commonly used as a proxy for this. The definition of a retired household follows from this, as being a household where one form of income is New Zealand Superannuation, a war pension or other government pension. However, it is recognised that a retired household may include one or more persons who are still working part-time or even full-time.