Public Liability Insurance for Business

No matter the size or shape of your business or the industry you operate in, as a New Zealand business owner, you expose yourself to risks every day.

Public liability insurance, also known as broadform liability or general liability, provides cover for your legal liability to others should your business, employees or products cause injury to a person or the loss or accidental damage of other people’s property.

Public liability insurance typically covers*:

- Defence costs and the resulting compensation relating to personal injury or damage to property arising in connection with activities of your business.

- Cover for exemplary damages awarded by any New Zealand court in respect to personal injury.

- Liability as a result of being a commercial property owner or commercial tenant.

- Liability from property in your care, custody or control.

- Liability in connection with the cost for physically recalling or withdrawing products that have given rise to a claim.

- Defence costs.

*Always carefully review the policy wording or speak to an insurance broker/professional to understand the inclusions and exclusions of your cover.

Why You Need Public Liability Insurance

Public liability risks can arise from the simplest events, such as a member of the public visiting your business premises. Should an allegation arise that damage to property or injury was caused because of your business activities, you could be held responsible and therefore face the costs of defending the allegation and any damages you may be ordered to pay to the third party.

Depending on the allegation, these costs can be significant, which is why public liability insurance is so important and often has cover in the millions of dollars.

Without this cover, you and your business could face severe financial strain from legal defence costs and the damages you may be required to pay, not to mention the time-consuming nature of organising lawyers and experts for your defence, the business interruptions you may face during the process, and the general stress and strain of defending a claim against your business.

Public liability insurance cover can remove the weight of responsibility for all the above from your shoulder, as your insurer will step in and manage the process of defending the allegation and any resultant liability.

Who Needs Public Liability Insurance?

A New Zealand business owner in any industry, from a sole trader or contractor to the head of a multinational company, should seek the protection of public liability insurance. It may sound morbid, but without a public liability insurance policy, a small business owner could be one incident or accident away from closing their doors.

Because the scale and extent of risks differ from one business to another, it’s important to understand the things that could potentially go wrong in the day-to-day operations of your business to ensure you secure the appropriate level of cover.

Most insurance companies have website content that could be helpful for you to better understand what you need to consider when thinking about public liability insurance. Also seeking the guidance from a suitably qualified insurance professional like a broker or adviser will also be helpful.

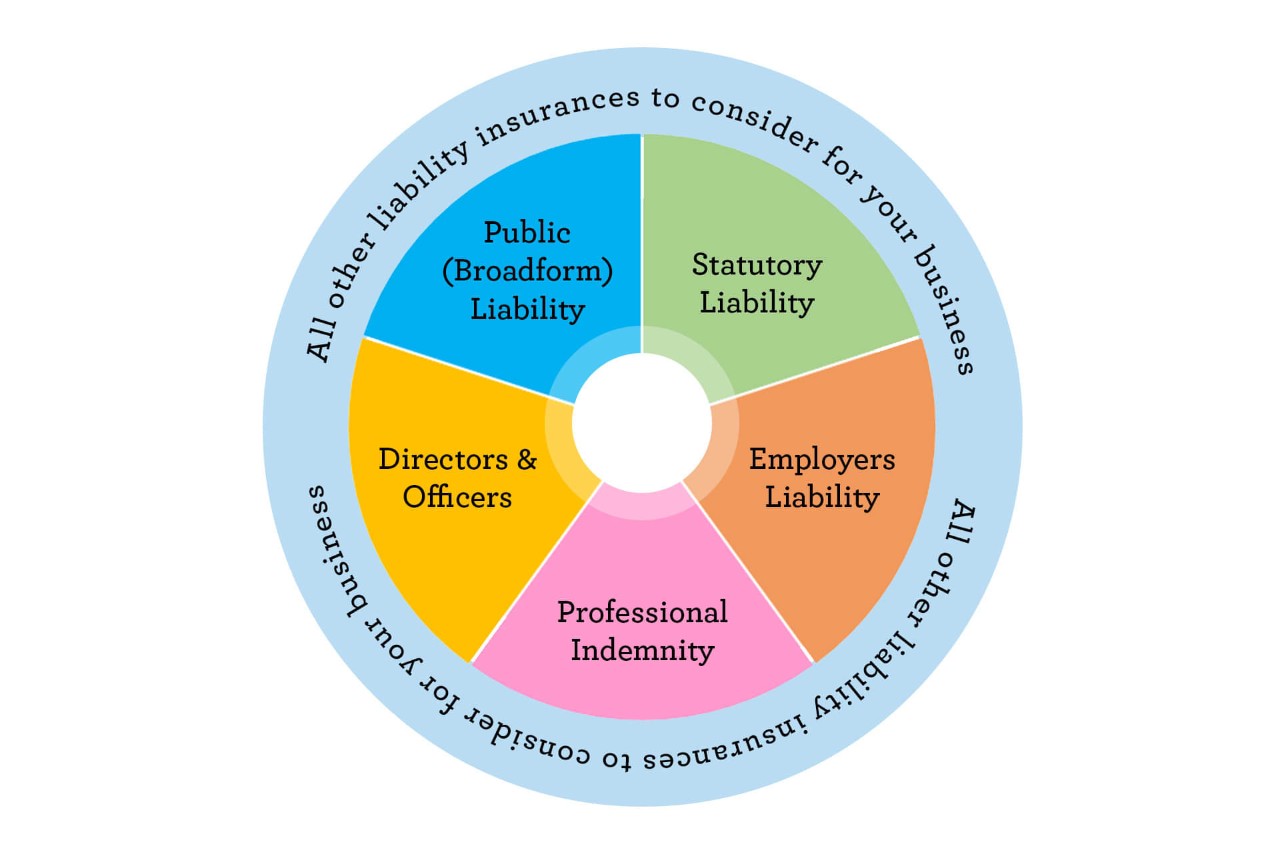

Types of Liability Insurance

Public liability insurance is just one of many insurance policies that can protect you against different liability risks. It is becoming increasingly common for liability insurances to be purchased as a package that includes several types of liability insurance cover.

Liability insurances commonly packaged together include public liability, statutory liability, employers liability, directors and officers liability policies, and there are a number of other liability policies that can be added to your business insurance package.

Speaking with an advisor or broker can help to identify additional liability policies that may be required to fully cover the liability exposures of your business.

Statutory liability insurance

Statutory liability insurance provides cover for fines, penalties, reparation, and defence costs arising from unintentional breaches of New Zealand laws. This includes the costs of defending prosecutions brought by regulatory authorities under various Acts of Parliament together with cover for any accompanying financial penalties*.

*Note: you cannot get insurance for fines under Health & Safety legislation in New Zealand.

Employers liability insurance

Employers liability insurance covers you as a business owner for legal liability and/or costs relating to injury sustained by employees as part of their work duties that is not covered by ACC.

Professional indemnity insurance

Professional indemnity insurance provides cover to businesses and professionals against liability and related legal costs arising from advice provided as part of their business activities.

Directors and officers liability insurance

Directors and officers liability insurance provide you with cover as a director or senior officer for costs in defending claims made against you while carrying out your duties.

Each business is unique, and there are other liability insurances to consider related to your business activities. It's a good idea to speak to an insurance specialist to understand the right liability coverage for your business.

The information in this blog is of a general nature and does not constitute financial or other professional advice. Policy limits and exclusions apply - refer to the policy wording for full terms and conditions.