Insurance for Renters

Get your stuff covered with contents insurance for renters. Quick and easy to quote and buy online.

If you’re flatting with friends or renting your own place, it’s important to protect what matters to you. Often overlooked and undervalued, contents insurance for renters provides cover for those who live in rental properties.

Contents insurance can provide cover for your furniture, electronics, clothing, appliances, and any other items within the home, and if noted under Everyday cover, away from the home. It can help you in the event of theft, damage, or disaster and can also cover your belongings if they are damaged or destroyed by a fire, flood, or other natural disaster.

Compare our contents insurance for renters

Optional with portable valuables benefit

At home (away from home optional with portable valuables benefit)

optional with portable valuables benefit

$2,500 per item or set up to $10,000 total

$1,000 per item or set up to $4,000 total

Up to $15,000

Up to $10,000

Up to $1,000

Up to $500

Up to $1,000

Up to $500

Up to $2,500

Up to $1,500

Up to $1,500

Up to $1,000

Need help with your car insurance too?

It can be easier having your insurance all in one place. We can help you get your A to B covered with car insurance too. Whether you're looking for comprehensive or third party car insurance, we've got you covered.

Quote or buy online now

Contents insurance for renters FAQs

No. Only your belongings, or those of your immediate family members who live with you, will be covered at the flat under your policy. Your flat mates, boarders or other guests will need to take out their own contents policy to cover their stuff.

Yes. Your mobile phone is included under general items in your contents policy. Under Everyday cover you will need to select the portable valuables optional benefit if you want cover for accidental loss or damage away from your home.

Yes. If you are permanently moving to a new address in New Zealand, most of your contents will be covered while they are being moved for loss or damage caused by fire, flood, collision, overturning or theft of the vehicle carrying them. Cash, cards and similar cash substitute items are not covered during transit. The policy wording provides the full list of excluded items.

Yes. We cover home office equipment kept at your home for personal or business use. Our comprehensive - Everyday Plus contents policy provides cover up to $15,000 and our Everyday contents policy provides cover up to $10,000.

It's hard to know how much an item is worth, especially after having owned it for a few years. It's worthwhile considering how much it would cost to replace your stuff if you suffered a total loss. Not just your electronics and jewellery, but your clothing, appliances and kitchen utensils too.

To help you get an estimated cost of your contents, look at prices for similar items online and always use the standard retail price.

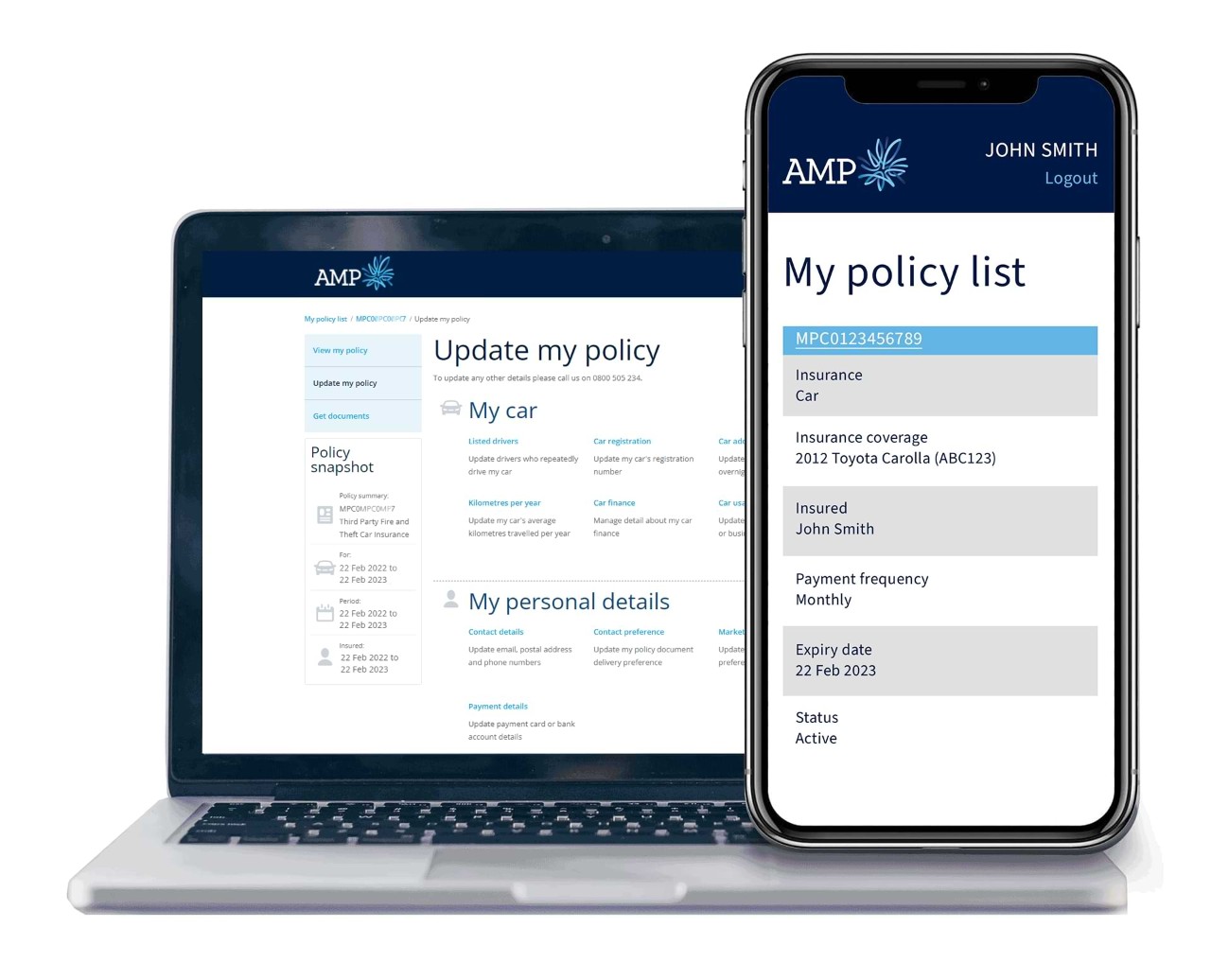

Manage your insurance with AMP My Insurance Manager

When you purchase an online policy with AMP you can view, update, and keep track of your insurance 24/7 with My Insurance Manager. Login or register today.

Login now

Need a little help?

If you're unsure about your insurance needs, we're here to help. Give us a call on 0800 267 263 and speak to one of our insurance specialists or book in a call at a time that suits you.

Have an existing insurance adviser or broker? Find them here.

Insurance (excluding travel) is underwritten by Vero Insurance New Zealand Ltd. This information is only intended as a guide. Policy limits and exclusions apply. Please refer to the policy wording for full terms and conditions.