Investment risk, explained

All investing comes with a level of risk. You aren’t guaranteed to make money when you invest, and you might lose the money you start with. But that doesn’t mean you have to avoid investing all together. Here, you can learn more about types of investment risk and tips to help you understand your attitude towards risk.

Types of investment risk

Funds risk

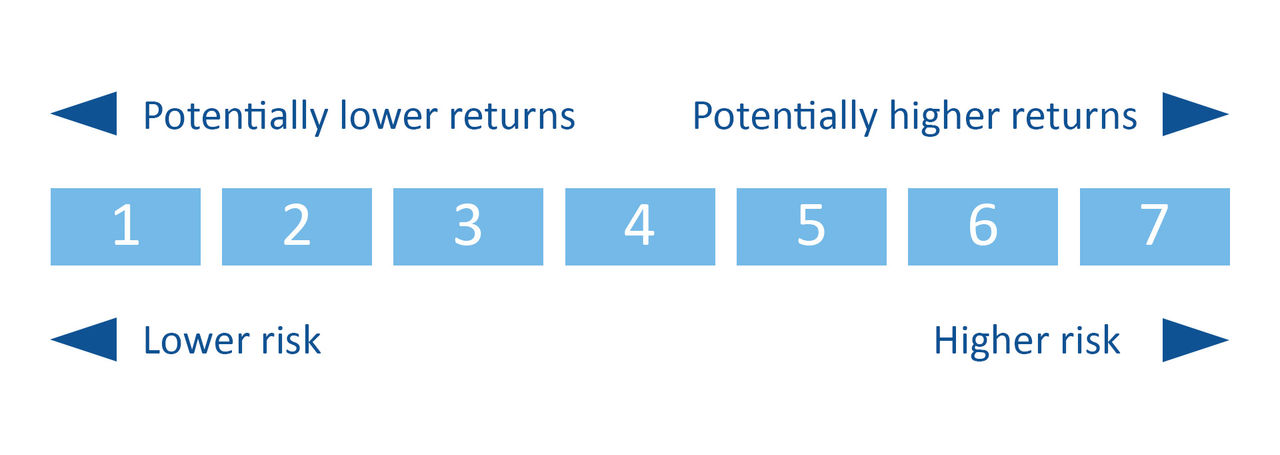

Higher risk funds tend to be invested largely in growth assets (such as shares) and are generally associated with higher levels of ups and downs. Lower risk funds often have a larger allocation of investment to income assets (such as cash and bonds) and therefore historically experience less ups and downs.

The higher on the risk scale the fund you are invested in, the greater the potential for the value of the fund to fluctuate. However, they may potentially generate better returns over the long term when compared to a lower risk fund.

Lower risk funds are known to typically provide more consistent but lower returns over the long term.

Market risk

Markets go through cycles and the value of your fund will follow that cycle. You should expect some ups and downs will happen to the value of your fund.

Generally, the higher risk fund choices, like an aggressive fund, the higher the returns are likely to be over time but there will be a greater chance of ups and downs along the way. For a lower risk funds choice, like a conversative fund, it is likely that returns will be lower over time but there’s less chance of ups and downs along the way.

Asset class risk

The fund type you choose will determine, to a degree, the mix of assets in your fund. A fund is made up of a range of different assets from cash, cash equivalents, bonds, loans to government/companies and shares.

A conversative fund will have more lower risk assets like cash and bonds as they change less in value. There will be far less higher risk assets like shares in a conversative fund as they go up and down in value. You want to pick a fund with a risk tolerance that you are comfortable with.

Watch our video below to understand what terms like risk and investment mean and how they work.

What level of risk are you comfortable with?

Understanding your risk tolerance is important when it comes to investing and will help you to:

- Choose appropriate investments: Aligning your fund choice with your risk tolerance ensures you're not exposed to unnecessary anxiety. If you’re naturally cautious, a fund with less risk might be the right option for you or if you are a bit of risk taker, a higher risk fund.

- Make informed decisions: During market downturns, risk-averse investors can panic and change funds, leading to further losses. Knowing your risk tolerance could help you stay calm and make sound investment decisions based on your long-term goals.

- Manage your emotions: Investing involves ups and downs. Knowing your risk tolerance helps you navigate market fluctuations without letting emotions cloud your judgment.

Other factors to consider when it comes to your risk attitude:

- Age: The younger you are, the more time you have till you need the cash in your investment and can tolerate riding out the ups and downs of the market with a higher risk fund for potential long-term growth. Older investors nearing retirement may want to prioritise keeping their investment balance steady, leading to a lower risk tolerance.

- Financial situation: If you have financial dependents relying on you, you might prioritise stability and be better with a lower risk fund option. If you have a decent amount of savings and are less reliant on investment income, you might be more comfortable with higher risk.

- Investment goals: Short-term goals like saving for an overseas holiday might require lower risk investments, while long-term goals like retirement might benefit from a mix of higher and lower risk assets in your fund mix.

- Your climate change views: If you are keen to invest in funds that support sustainable projects, you may want to spend some time reviewing what providers offer. The availability of sustainable or responsible funds offered by investment providers are growing every year. The Responsible Investment Association of Australasia (RIAA) is on a mission to champion responsible and sustainable investing across Australia and New Zealand. They have an online tool you can use to find the investment funds they have certified being responsible and ethical.

Tips for assessing your risk attitude

- Consider online risk tolerance assessments: Sorted has a great online questionnaire to help you determine your risk level.

- Reflect on your past financial decisions: How have you reacted to previous financial gains and losses? This can offer insights into your risk tolerance.

- Seek professional guidance: Financial advisers can help you assess your risk tolerance and develop a personalised investment plan. You can book a time to talk to one of our advisers.

Your attitude to risk is not static and can change over time. Regularly reviewing your investments and risk tolerance in light of your changing circumstances is crucial for remaining comfortable with the level of risk you have chosen.

Recommended reads

Market volatility and ways to handle it

Concerned about your investment balance? Learn more about ways to handle market ups and downs. Learn more >

Managed Funds, KiwiSaver, or term deposits?

Explore the key differences between Managed Funds, KiwiSaver and term deposits. Learn more >

The basics of diversifying investments

Get up to speed on one of the key strategies to balance risk and reward in your investment portfolio. Learn more >