Ways to use KiwiSaver - your withdrawal options

While KiwiSaver is designed to help you save for your retirement, there are exceptions that may allow you to access your KiwiSaver savings at other stages of life too.

The process of withdrawing from KiwiSaver can change depending on the circumstances. As your KiwiSaver provider, AMP will always be there to help.

You can only withdraw from your KiwiSaver in very specific circumstances, and many people who want to aren’t actually eligible to. By getting in touch with an AMP KiwiSaver expert, you can check your eligibility, then get valuable assistance with filling in the paperwork and doing everything by the book, to ensure you gain access to the funds you need, when you need them.

In particularly challenging cases, we can even refer you to specialised agencies and professionals for help.

The situations in which you may be able to withdraw from your KiwiSaver include:

- Retirement: You can withdraw some or all of your KiwiSaver savings at retirement, or more specifically when you reach the qualifying age (65).

- First home: Eligible KiwiSaver members can withdraw almost all of their savings to purchase their first property.

- Hardship: You may be able to access your KiwiSaver savings in extenuating circumstances, such as financial hardship.

When can I withdraw my retirement savings from KiwiSaver?

The qualifying age to withdraw from the KiwiSaver scheme is currently 65, but for those who joined KiwiSaver (or a complying superannuation fund) before 1 July 2019, the qualifying date is the latter of:

- The qualifying age for New Zealand Superannuation (currently 65);

- Five years after you first joined KiwiSaver (or a complying superannuation fund if you have transferred to KiwiSaver from another country’s scheme);

- Five years after Inland Revenue received your first contribution (whether employer contribution or voluntary contribution).

If you are over 65 but haven’t yet reached your qualifying date, you can choose to bring it forward. You will however lose eligibility for government and employer contributions from that date.

The process of withdrawing from KiwiSaver after retirement

Having reached the qualifying age, you have three KiwiSaver withdrawal options in retirement:

Regular

Pay yourself from your KiwiSaver, withdrawing a specific amount at regular intervals (monthly/fortnightly/quarterly).

Partial

Withdraw a lump sum from your KiwiSaver only when you need to.

Full

Withdraw all of your KiwiSaver savings at once and close your KiwiSaver account.

It’s important to understand that you don’t need to withdraw all of your savings at retirement, and there’s a compelling argument for why it might be good that you don’t. Money in your KiwiSaver account is placed in investment funds and will continue to deliver returns into your retirement. The more you leave in, the more compounding returns you’ll earn! This is why many KiwiSaver members choose to only take out what they need, either through regular or partial withdrawals.

Making a retirement withdrawal is a matter of downloading and completing our retirement withdrawal form. Send the completed form to us along with the listed supporting documents (ID, proof of address, statutory declaration), and we’ll do the rest. You should see your money in 8-15 days, as the application must also be processed by IRD.

Once you have made your first withdrawal, the process of making regular withdrawals thereafter can be a little less onerous – you don’t have to provide another stat dec, for example. Simply fill out our subsequent retirement withdrawal form.

Withdrawing KiwiSaver when buying your first home

If you’re ready to buy your first home, or the land to build your future home on, you may qualify to be use most of your KiwiSaver savings to help with the first home deposit.

If you’re eligible to make a KiwiSaver first home withdrawal you will just need to leave at least $1,000 in your KiwiSaver account, as well as any money transferred over from an international retirement scheme, such as Australian super or the UK pension.

You’ll need to meet certain criteria from Kāinga Ora to be eligible to use your funds to purchase your first home (or land), including:

- Buying a New Zealand property.

- Never having owned a property or made a first home withdrawal before.

- Living in the house or on the land you’re buying (no investment properties).

- Participating in KiwiSaver for at least three years.

- Not building on land you already own.

Keep in mind that the First Home Grant is another scheme that you can use to get into your first home sooner.

How to make a KiwiSaver first home withdrawal

The process of making a first home withdrawal from your KiwiSaver account begins with filling out the first home withdrawal application form. You send the completed form to KiwiSaver Scheme provider (AMP), along with the following supporting documents:

- A copy of the sale and purchase agreement.

- Proof of identity and address.

- A letter of undertaking from your solicitor.

- Your solicitor’s trust account details.

You can leave the rest to us! Approval usually takes 8-15 days, at which point the funds will be transferred to your solicitor’s account.

KiwiSaver withdrawal due to extenuating circumstances

Beyond a first home purchase there are a few other, very specific circumstances in which you may be allowed to access the funds from your AMP KiwiSaver Scheme account before your qualifying date – but only ever as a last resort, when all other avenues have been exhausted. If you meet the criteria, this might apply to you in the case of:

- Significant financial hardship: If you are suffering, or are likely to suffer from financial hardship, then you may be eligible for a significant financial hardship withdrawal from your AMP KiwiSaver Scheme savings. A Supervisor will determine whether you can make the withdrawal, and the amount you can withdraw, based on your circumstances. Your eligibility may include minimum living expenses, debt repayments and liabilities.

- Serious illness: If you are suffering from a serious illness, you may be able to make a serious illness withdrawal. This grants you access to some or all of your savings to help cover lost income and the costs of medical treatment. The decision is based on medical evidence reviewed by the Supervisor.

- Life-shortening congenital conditions: Similar to the above, if you are suffering from a life-shortening congenital condition you may withdraw some or all of your savings, though the amount is dependent on whether you have a listed or unlisted condition.

- Permanent emigration to Australia: If you permanently emigrate to Australia, you can transfer all of your KiwiSaver savings to an Australian complying superannuation scheme. (It’s important to first confirm with your Australian provider that they will accept a transfer, as not all do.)

- Permanent emigration elsewhere: A year after you permanently emigrate from New Zealand to another country (other than Australia), you may withdraw your KiwiSaver money minus any Government contributions and money that you previously transferred over from an Australian super fund.

- Withdrawal of Australian retirement savings: If you have reached the age of 60, and you have retired under Australian law, you can access any retirement funds that you have transferred over to KiwiSaver from an Australian super fund.

- Death: In the event of your death, your KiwiSaver savings will be paid to your estate, or if your savings are less than a prescribed minimum amount (currently $15,000), the funds may be paid to the bank account of a permitted recipient, such as a partner or family member.

Find out more by downloading our AMP KiwiSaver Scheme Product Disclosure Statement.

The process of withdrawing from KiwiSaver in extenuating circumstances

The process of accessing KiwiSaver funds before your qualifying age will vary depending on the circumstances. A number of rules and exclusions apply to each of the extenuating circumstances listed above, so we always recommend that you speak to one of our KiwiSaver advisers before you make any decision, so that you gain a better understanding as to whether it is the right move for you.

If you believe that you meet the requirements of one of the extenuating circumstances, you can apply to make a withdrawal using the forms that we have linked to above.

Generally speaking, a licensed Supervisor will then review your completed application, and will ask to see any necessary supporting documentation. If they are satisfied that you meet the eligibility criteria, they will also decide exactly how much money you are permitted to withdraw from your KiwiSaver account.

Looking for expert KiwiSaver advice?

We recommend speaking to a financial adviser when looking for financial advice. By speaking with a financial adviser, you can find out - how your plan is working (or not) for you, and they can provide guidance on some suggested changes if needed.

As an AMP KiwiSaver Scheme customer you have access to financial advice whenever you need it which can be obtained either through AMP or an external Adviser. The financial advice that can be provided by an internal AMP Adviser is limited to AMP products, whereas an external Adviser may be able to advise you on a broader range of financial matters.

Keep track of your KiwiSaver funds

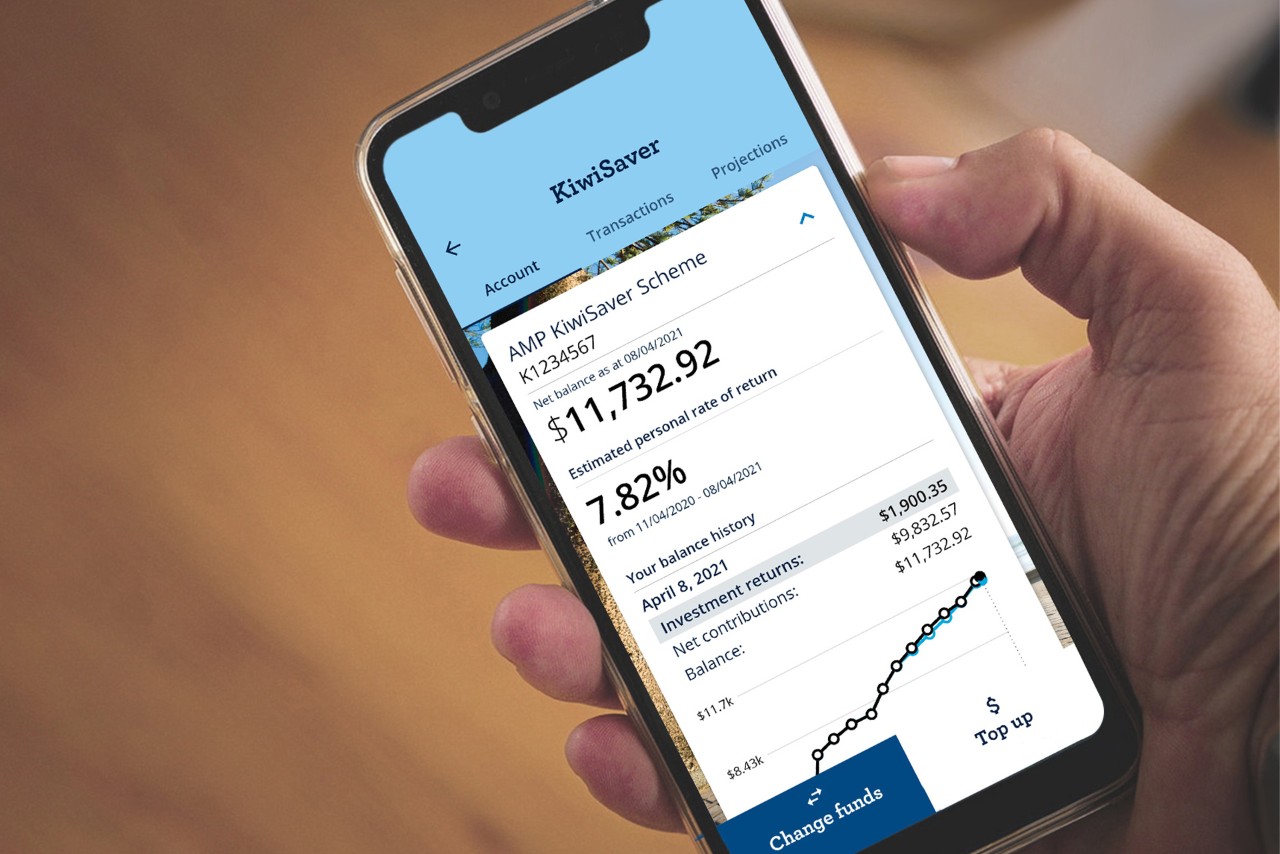

Our online portals, MyAMP and My AMP app, make it easy and convenient to keep track of the balance of your AMP KiwiSaver Scheme account. MyAMP also lets you keep your personal details up to date, update direct debit contributions and switch investment funds.

Watch how your savings perform over time through our secure online portals, MyAMP and MyAMP app.

Want to take a break from contributing?

If you’re an employee, and have been a member of KiwiSaver for 12 months, you can take a break from contributing to your AMP KiwiSaver Scheme account. You could either take:

- a ‘savings suspension’ – for 3 months up to 12 months if you’ve been a member for 12 months or more

- an ‘early savings suspension’ - If you’ve been a member for less than 12 months, and are experiencing financial difficulty

It’s important to note that if you do stop contributing you may miss out on benefits such as employer contributions and Government contributions. To find out more or apply for a ‘savings suspension’, you can contact Inland Revenue on 0800 549 472.